As tax season approaches, many Wisconsin residents are gearing up to file their income taxes for the year 2023. One of the essential tools needed for this process is the Wisconsin Income Tax Forms 2023. These forms are necessary for individuals and businesses to report their income and calculate the amount of taxes owed to the state.

Wisconsin Income Tax Forms 2023 Printable are easily accessible online, making it convenient for taxpayers to download and print them from the comfort of their own homes. This allows for a hassle-free tax filing process, saving time and effort for both individuals and tax professionals.

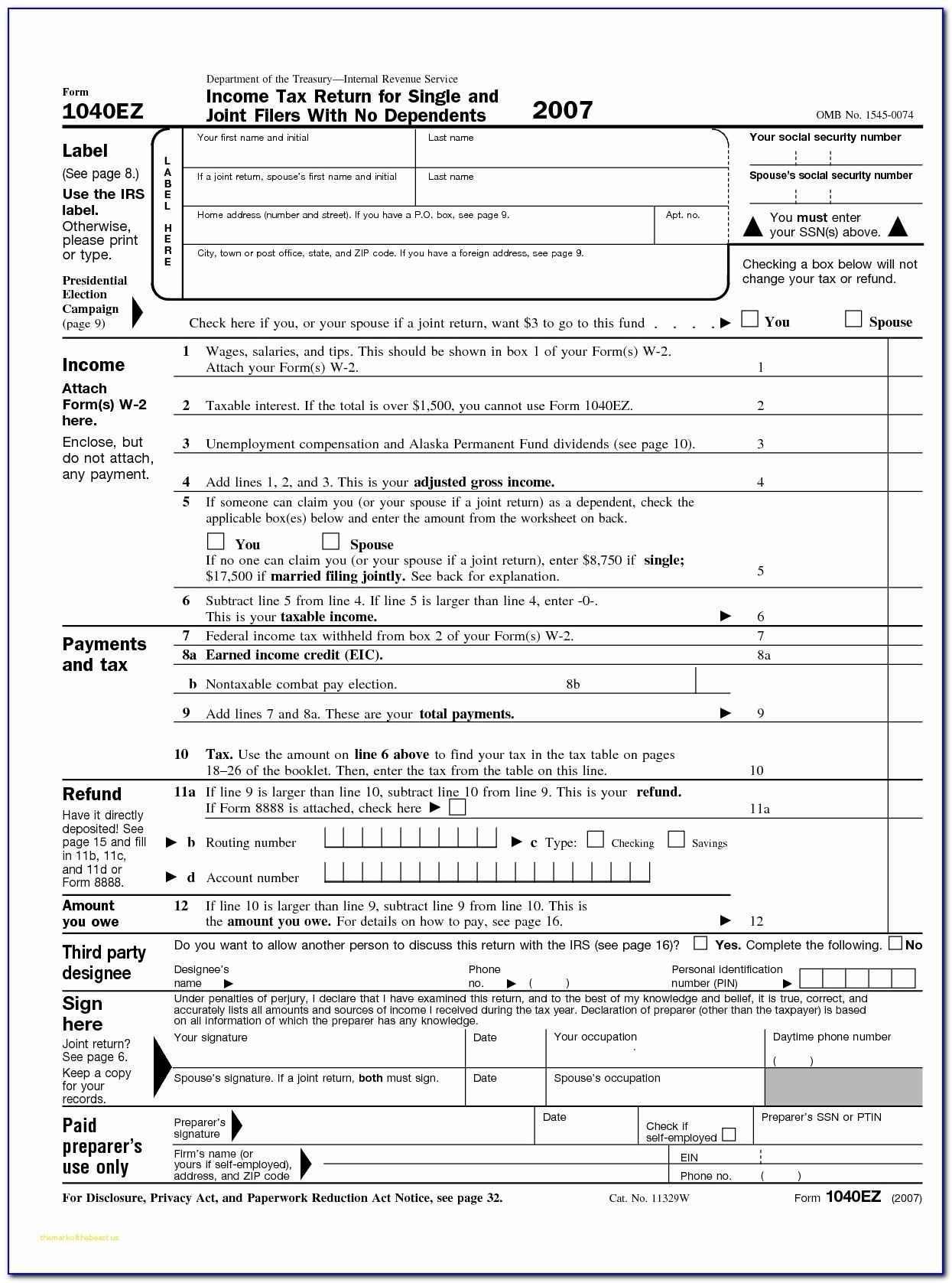

Wisconsin Income Tax Forms 2023 Printable

Wisconsin Income Tax Forms 2023 Printable

Wisconsin Income Tax Forms 2023 Printable

There are several different forms available for Wisconsin residents to use when filing their income taxes for 2023. These forms include the WI-Z Form for simple tax returns, the Form 1 for individual income tax returns, and various schedules for deductions and credits.

When filling out these forms, taxpayers must accurately report their income, deductions, and credits to ensure they are paying the correct amount of taxes owed. It is essential to carefully review and double-check all information provided on the forms to avoid any errors or discrepancies that could lead to penalties or audits.

For individuals who are not comfortable filling out their tax forms on their own, there are resources available to help. Tax preparers and accountants can assist with the process and ensure that all forms are completed accurately and submitted on time to avoid any potential issues with the IRS.

In conclusion, Wisconsin Income Tax Forms 2023 Printable are a crucial component of the tax filing process for residents of the state. By utilizing these forms and accurately reporting their income, deductions, and credits, taxpayers can ensure they are compliant with state tax laws and avoid any penalties or audits. Be sure to download and print the necessary forms well in advance of the tax filing deadline to allow ample time for completion and submission.