When it comes to filing taxes, it is important to accurately report your income to the state of New Jersey. However, there are instances where individuals may have zero income to report. In such cases, a zero income statement can be submitted to the state to fulfill tax requirements.

A zero income statement is a declaration that an individual did not earn any income during a specific tax year. This statement is important for maintaining compliance with tax regulations and ensuring that individuals are not penalized for failing to report income.

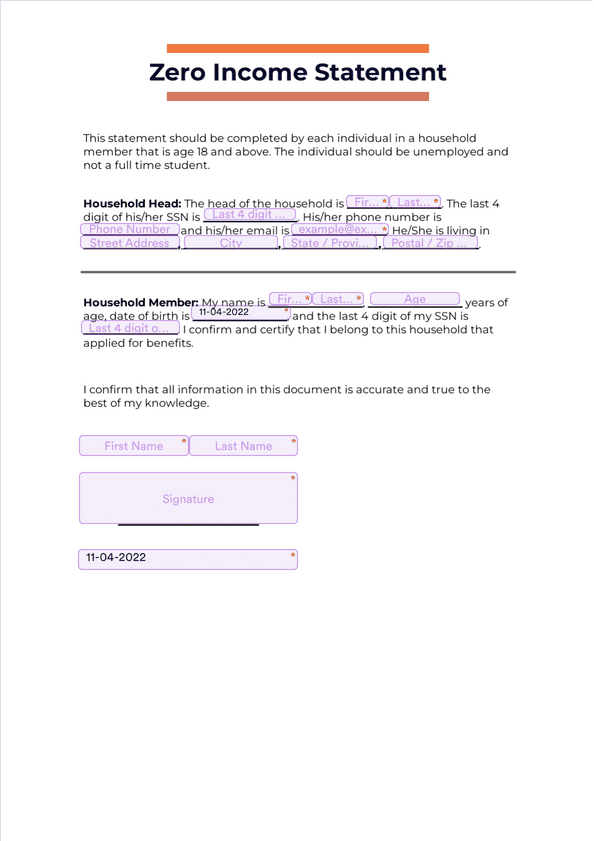

Printable Zero Income Statement State Of New Jersey

Printable Zero Income Statement State Of New Jersey

For residents of New Jersey who have zero income to report, it is essential to obtain a printable zero income statement form from the state’s tax department. This form can be easily downloaded from the official website and filled out with the necessary information.

When completing the zero income statement form, individuals must provide their personal details, including their name, address, and social security number. They must also certify that they did not earn any income during the tax year in question and sign the form to attest to its accuracy.

Once the zero income statement form is completed, it can be submitted to the New Jersey Department of Taxation for processing. It is important to ensure that the form is submitted by the deadline to avoid any potential penalties or fines for late filing.

In conclusion, for individuals in the state of New Jersey who have zero income to report, obtaining and submitting a printable zero income statement is a crucial step in fulfilling tax obligations. By following the necessary steps to complete and submit this form, individuals can maintain compliance with tax regulations and avoid any potential repercussions for failing to report income.