When borrowing or lending money, it is important to have a formal agreement in place to avoid any misunderstandings or disputes in the future. A simple loan agreement form can help both parties clearly outline the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any other relevant details.

Having a written agreement can provide peace of mind and ensure that both parties are on the same page. It can also serve as a legal document in case of any disputes or issues that may arise during the loan repayment process.

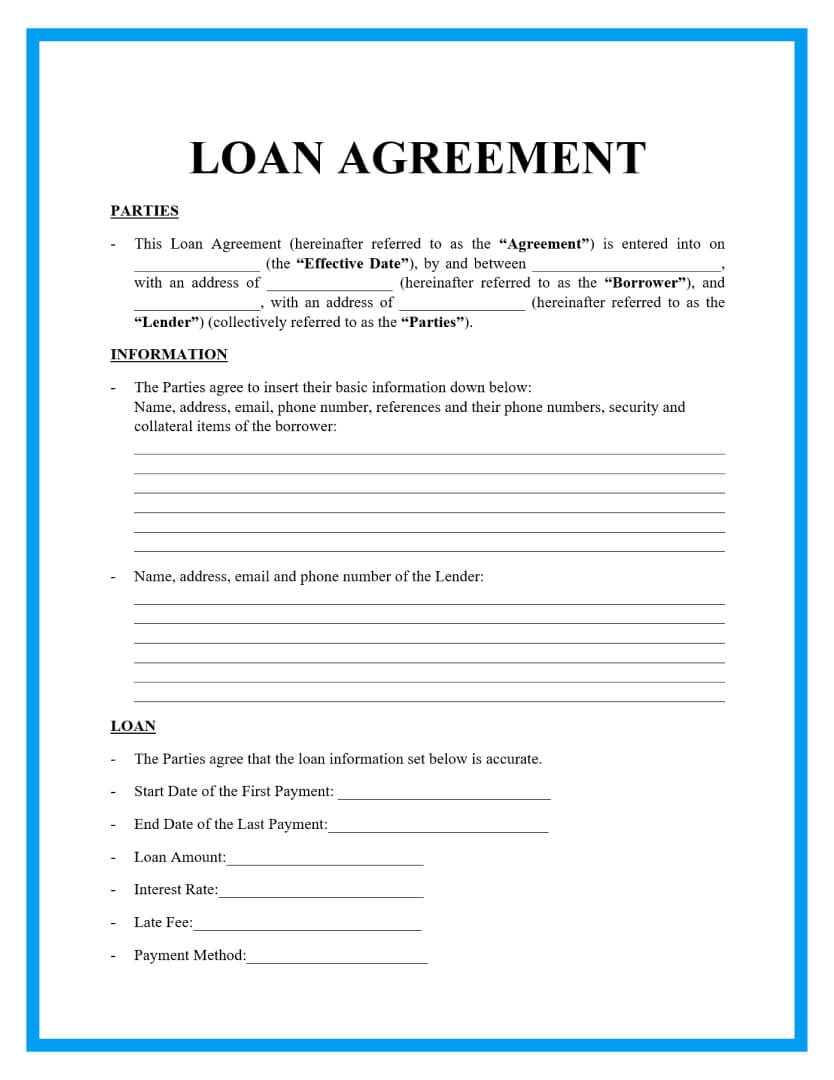

Printable Simple Loan Agreement Form

Printable Simple Loan Agreement Form

Printable Simple Loan Agreement Form

A printable simple loan agreement form is a convenient and easy way to document the terms of a loan agreement. This form typically includes sections for the borrower’s and lender’s information, details of the loan amount and interest rate, repayment schedule, and any collateral or guarantors involved.

By filling out a simple loan agreement form, both parties can clearly understand their rights and obligations regarding the loan. This can help prevent any misunderstandings or conflicts down the line and ensure a smooth and transparent lending process.

It is important to carefully review the terms of the loan agreement before signing to ensure that both parties are in agreement. If there are any discrepancies or concerns, they should be addressed and clarified before proceeding with the loan.

Once the loan agreement form is signed, both parties should keep a copy for their records and refer back to it as needed throughout the loan repayment period. This can help ensure that the terms of the agreement are being followed and that any issues or changes can be addressed promptly.

In conclusion, a printable simple loan agreement form is a valuable tool for documenting and formalizing a loan agreement. By clearly outlining the terms and conditions of the loan, both parties can protect their interests and ensure a smooth and transparent lending process.