When entering into a financial agreement with another party, it is important to have a written contract that outlines the terms and conditions of the payment arrangement. A printable payment agreement is a useful tool for both parties to ensure clarity and accountability throughout the payment process.

Whether you are lending money to a friend, leasing a property, or offering services to a client, a payment agreement can help protect both parties in case of any disputes or misunderstandings. By clearly outlining the payment schedule, amount due, and any penalties for late payments, both parties can have peace of mind knowing that the terms are agreed upon and documented.

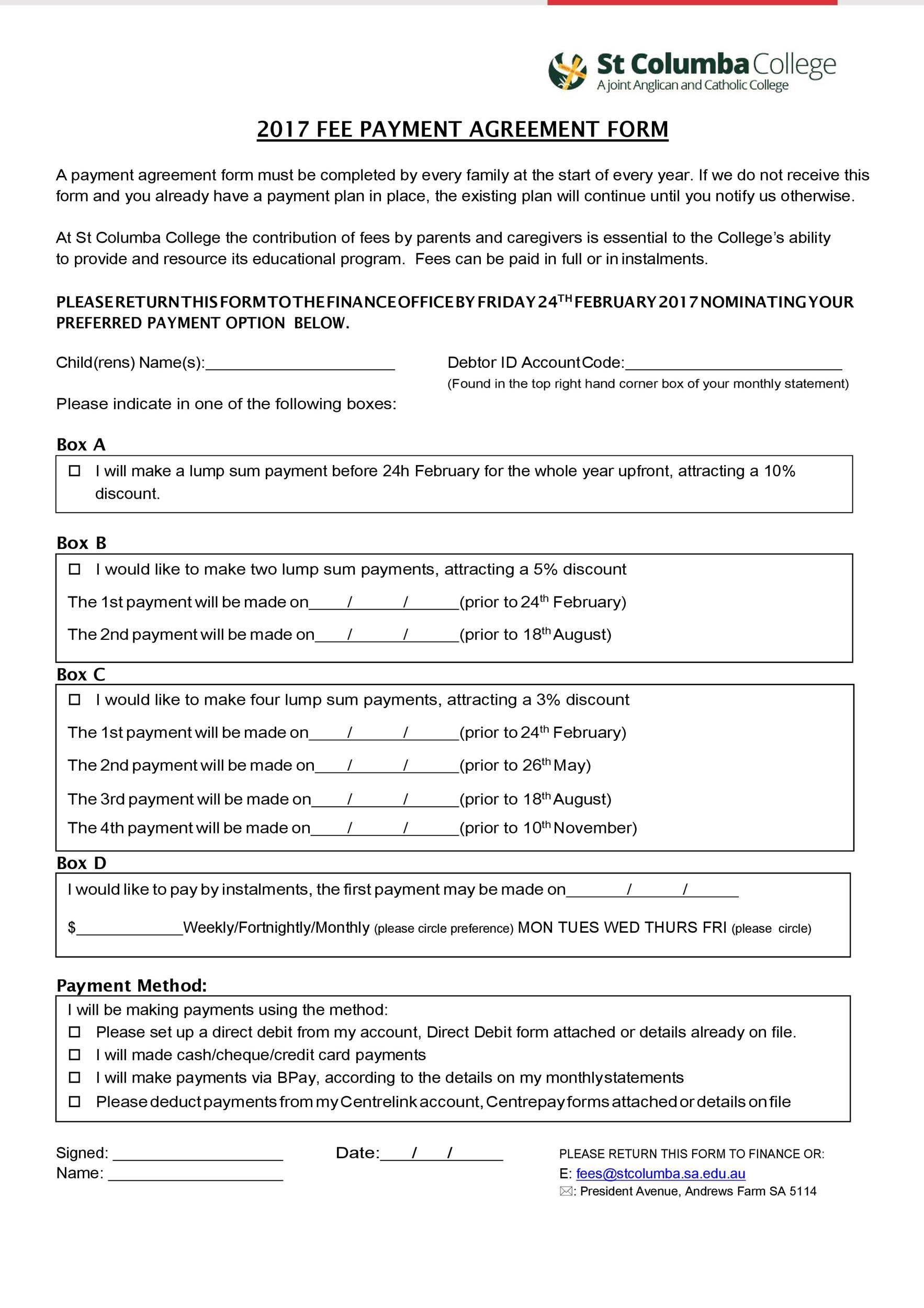

When creating a printable payment agreement, it is important to include the names and contact information of both parties, a description of the goods or services being provided, the total amount due, and the payment schedule. Additionally, it is advisable to include any terms regarding late payments, interest rates, and consequences for defaulting on the agreement.

Having a written payment agreement not only protects both parties involved, but it also serves as a legal document that can be used in case of any disputes or legal proceedings. By having a clear and concise agreement in writing, both parties can refer back to the terms and conditions that were agreed upon at the beginning of the transaction.

Printable payment agreements can be found online or created using a template to customize to your specific needs. By filling in the necessary information and signing the agreement, both parties are acknowledging their commitment to the terms outlined in the agreement. It is always recommended to have legal counsel review the agreement before signing to ensure that all parties are protected.

In conclusion, a printable payment agreement is a valuable tool for any financial transaction to ensure that both parties are on the same page regarding payment terms and conditions. By documenting the agreement in writing, both parties can have peace of mind knowing that the terms are clear and legally binding. Whether you are a lender or a borrower, having a payment agreement in place can help prevent any misunderstandings or disputes down the line.