Filing your local income tax return in Pennsylvania is an essential task for residents who earn income within the state. The form is used to report your earnings and calculate the amount of local income tax you owe to the municipality in which you reside. It is important to accurately complete this form to avoid any penalties or fines.

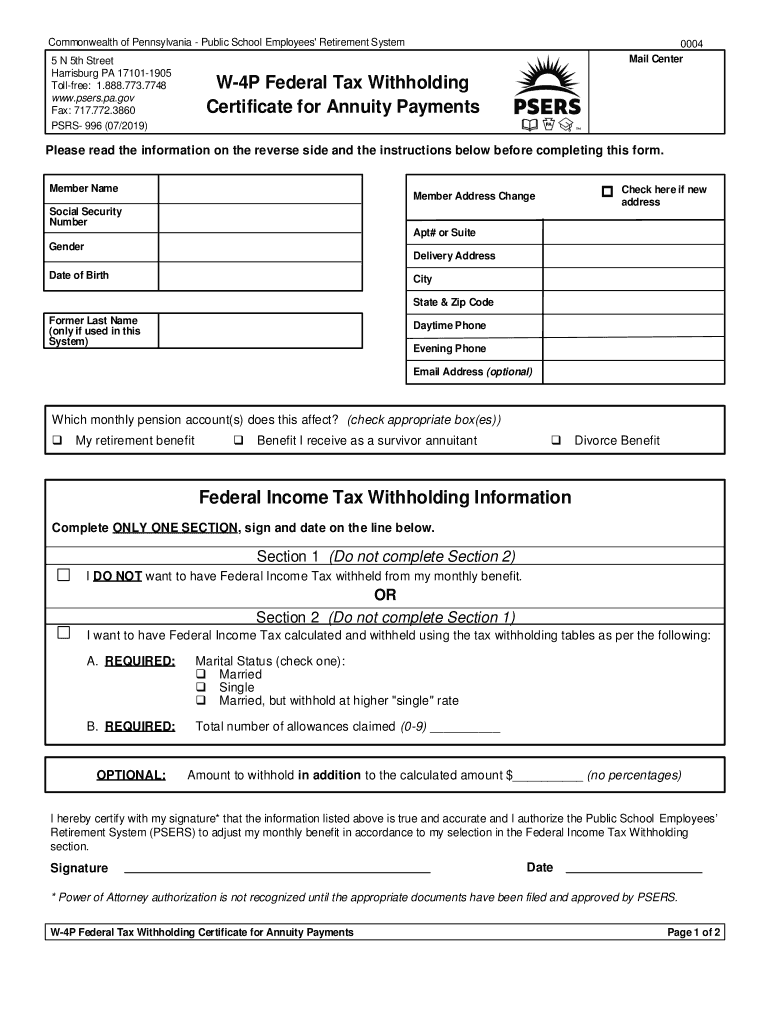

When it comes to filing your local income tax return in Pennsylvania, having a printable form can make the process much easier. The form typically includes sections for you to enter your personal information, such as your name, address, and social security number. It also includes sections to report your income and deductions, as well as calculate the amount of tax you owe.

Printable Pa Local Income Tax Return Form

Printable Pa Local Income Tax Return Form

Before filling out the form, make sure you have all the necessary documents on hand, such as your W-2s, 1099s, and any other relevant tax documents. This will ensure that you accurately report your income and deductions, which will help you avoid any discrepancies or audits.

Once you have completed the form, make sure to review it carefully to check for any errors or omissions. It is also a good idea to double-check your calculations to ensure that you have accurately calculated the amount of tax you owe. Once you are satisfied with the form, you can then submit it to the appropriate municipality along with any required payment.

By utilizing a printable Pa local income tax return form, you can streamline the process of filing your taxes and ensure that you accurately report your earnings. Remember to keep a copy of the form for your records and to follow up with the municipality to confirm that your return has been received and processed.

In conclusion, the printable Pa local income tax return form is a valuable tool for residents in Pennsylvania to fulfill their tax obligations. By accurately completing and submitting this form, you can avoid penalties and fines while ensuring that you are in compliance with local tax laws.