Filing taxes can be a daunting task for anyone, but when it comes to fiduciary income tax, things can get even more complex. For those residing in New York State, the Nys It205 form is used to report fiduciary income tax. This form is essential for estates and trusts to accurately report their income and pay the necessary taxes.

It’s important to understand the requirements and regulations surrounding fiduciary income tax in order to avoid any penalties or fines. By utilizing the Printable Nys It205 form, individuals can ensure they are compliant with state tax laws and accurately report their income.

Printable Nys It205 Fiduciary Income Tax

Printable Nys It205 Fiduciary Income Tax

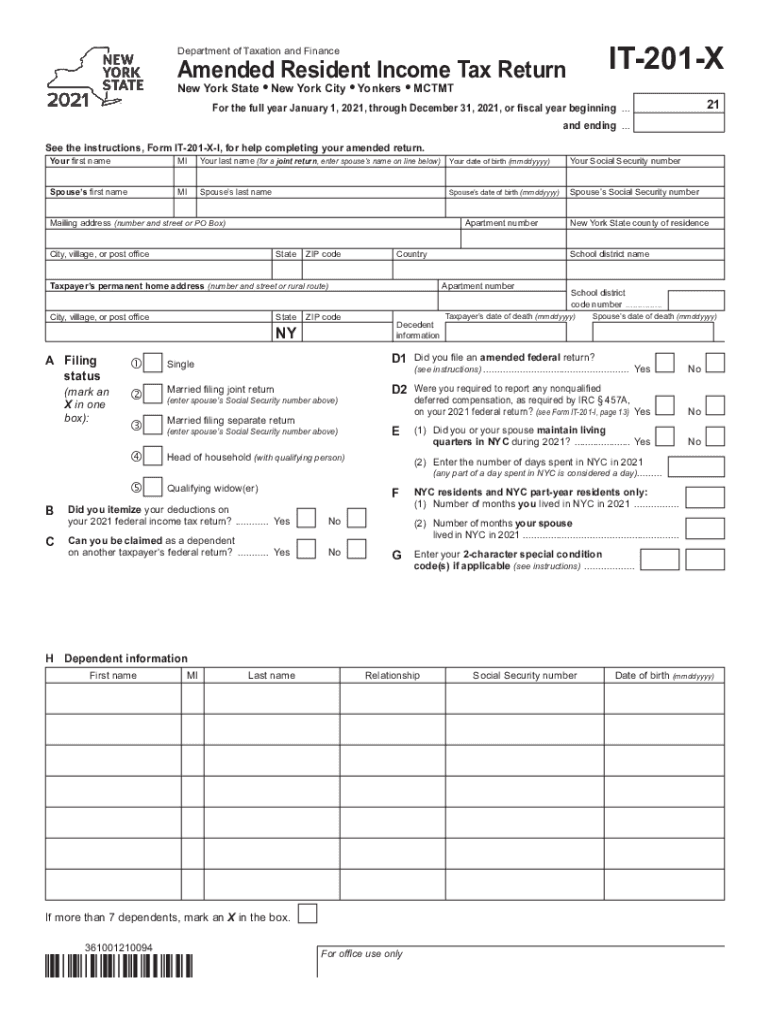

Printable Nys It205 Form

The Printable Nys It205 form is a crucial document for estates and trusts in New York State to report their income and calculate the corresponding tax amount owed. This form requires detailed information about the estate or trust, including income sources, deductions, and credits.

When filling out the Nys It205 form, it’s important to double-check all information for accuracy and completeness. Any errors or omissions could result in delays in processing or potential audits by the tax authorities. Utilizing the printable form can help ensure all necessary information is included and organized properly.

Once the Nys It205 form is completed, it must be submitted to the New York State Department of Taxation and Finance by the specified deadline. Failure to file or pay the required taxes on time can result in penalties and interest charges. By staying organized and using the printable form, individuals can streamline the tax filing process and avoid any potential issues.

In conclusion, understanding and properly filing fiduciary income tax is crucial for estates and trusts in New York State. The Printable Nys It205 form is a valuable tool that can help individuals accurately report their income and fulfill their tax obligations. By following the guidelines and requirements outlined in the form, taxpayers can ensure compliance with state tax laws and avoid any unnecessary penalties.