When tax season rolls around, it’s important to have all the necessary forms ready to ensure that you file your taxes accurately and on time. For New Jersey residents, having access to printable NJ income tax forms for the year 2017 can make the process much easier. These forms can be easily downloaded and printed from the comfort of your own home, saving you time and hassle.

Whether you are filing as an individual, married couple, or business entity, having the correct forms is crucial to meeting your tax obligations. By using printable NJ income tax forms for 2017, you can ensure that you have the most up-to-date documents needed to report your income, deductions, and credits accurately.

Printable Nj Income Tax Forms 2017

Printable Nj Income Tax Forms 2017

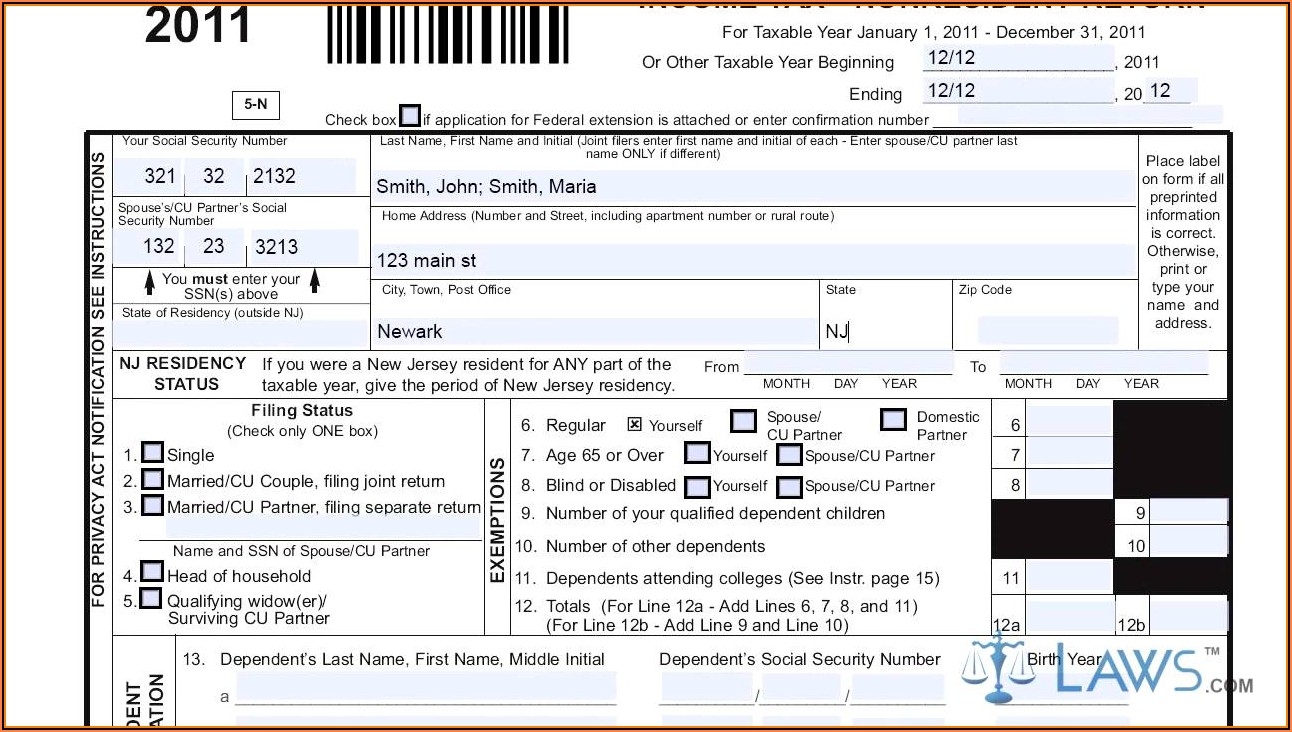

One of the most commonly used forms for New Jersey residents is the NJ-1040 form, which is used to report individual income tax returns. This form includes sections for reporting income, deductions, and credits, as well as calculating any tax owed or refunds due. Other forms, such as the NJ-1040NR for nonresidents and part-year residents, and the NJ-1040X for amended returns, are also available for download.

For business owners, forms such as the CBT-100 for corporation business tax returns and the CBT-100S for S corporations are essential for accurately reporting income and deductions. Additionally, forms such as the NJ-W4 for employee withholding allowances and the NJ-927 for employer quarterly reports are available for download to help businesses comply with state tax regulations.

By utilizing printable NJ income tax forms for 2017, taxpayers can streamline the process of filing their taxes and ensure that they are meeting all state requirements. These forms are easy to access and download, making it convenient for individuals and businesses to stay organized and up-to-date with their tax obligations.

As tax season approaches, be sure to take advantage of printable NJ income tax forms for 2017 to make the filing process as smooth as possible. By having the necessary forms on hand, you can avoid last-minute scrambling and ensure that your taxes are filed accurately and on time.