Filing income tax forms can be a daunting task, but having the right resources can make the process much easier. In 2014, residents of New Jersey had to file their income tax returns using the forms specific to that year. These forms are crucial for accurately reporting income, deductions, and credits to ensure compliance with state tax laws.

Printable Nj Income Tax Forms 2014 are readily available online for taxpayers to download and fill out. These forms include the necessary fields for reporting income, deductions, and credits, making it easier for individuals to accurately file their taxes. Having access to these forms can streamline the tax filing process and ensure that all necessary information is included.

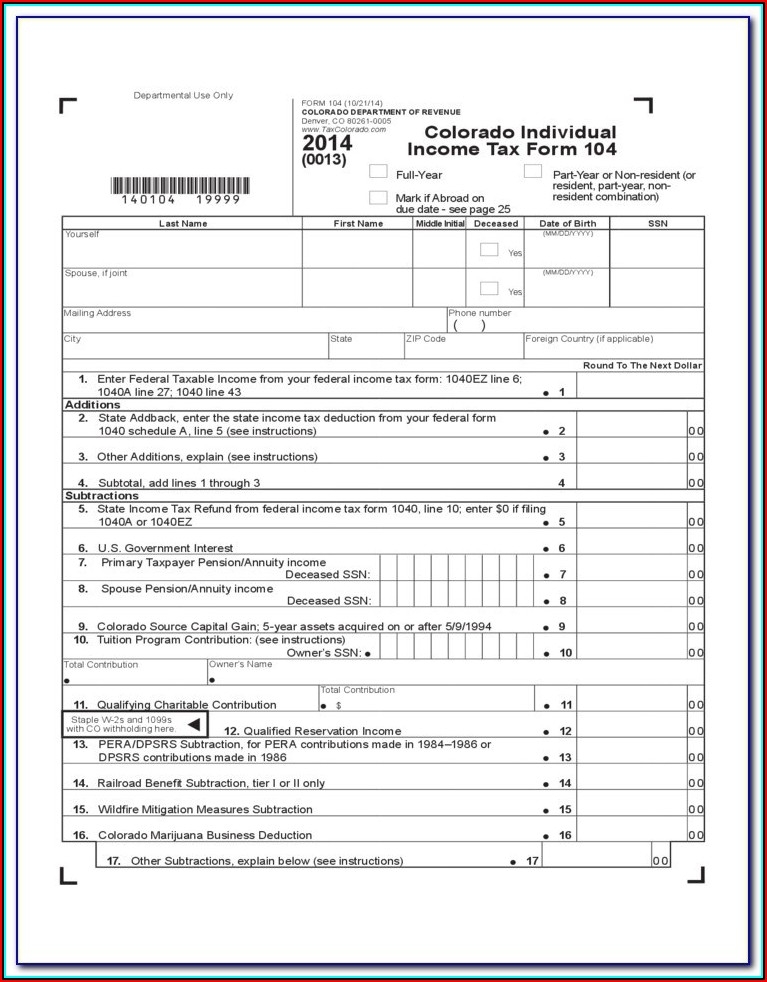

Printable Nj Income Tax Forms 2014

Printable Nj Income Tax Forms 2014

When filling out the Printable Nj Income Tax Forms 2014, taxpayers must carefully follow the instructions provided to avoid any errors that could lead to delays or penalties. It is important to double-check all information before submitting the forms to ensure accuracy and compliance with state tax laws. These forms serve as a crucial tool for taxpayers to report their income and claim any applicable deductions or credits.

By using the Printable Nj Income Tax Forms 2014, taxpayers can easily navigate the tax filing process and ensure that they are reporting their income accurately. These forms provide a structured format for reporting income, deductions, and credits, making it easier for individuals to file their taxes correctly. Additionally, having access to these forms online makes it convenient for taxpayers to download and print them from the comfort of their own homes.

Overall, Printable Nj Income Tax Forms 2014 are essential resources for New Jersey residents to accurately report their income and claim any deductions or credits they are eligible for. By using these forms, taxpayers can ensure compliance with state tax laws and avoid any potential errors that could lead to penalties. Accessing these forms online makes the tax filing process more convenient and efficient for individuals in New Jersey.