Filing your state income tax return can be a daunting task, but having the right forms can make the process much easier. In Nebraska, residents are required to file a state income tax return each year. To help simplify this process, the Nebraska Department of Revenue provides printable forms that individuals can use to file their taxes.

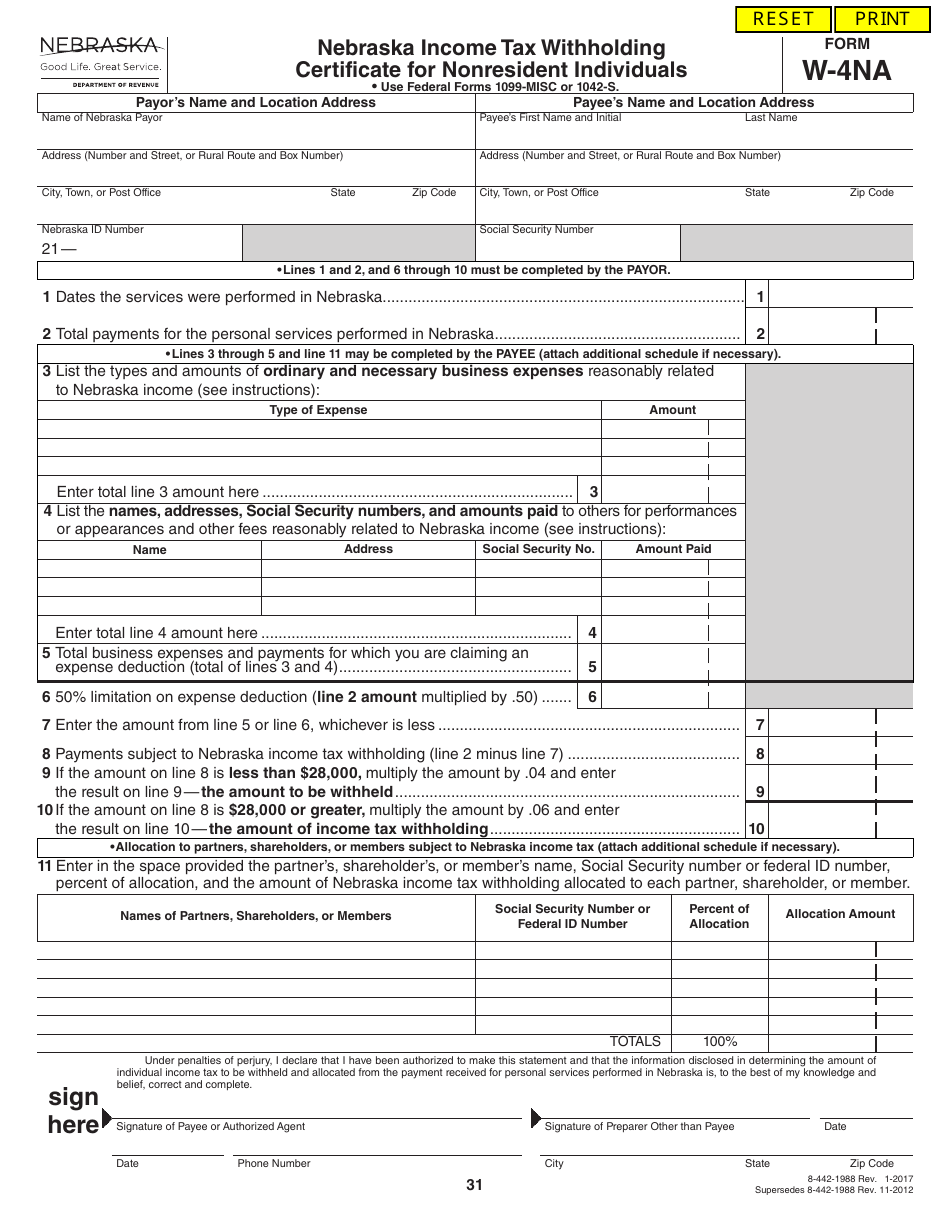

Whether you are a full-time resident, part-year resident, or non-resident of Nebraska, you will need to file a state income tax return if you earned income in the state. The printable forms provided by the Nebraska Department of Revenue cover various tax situations, including income from wages, self-employment, rental properties, and more.

Printable Nebraska State Income Tax Forms

Printable Nebraska State Income Tax Forms

When it comes to filing your Nebraska state income taxes, having the right forms is crucial. The Nebraska Department of Revenue offers a variety of printable forms on their website, including Form 1040N, Nebraska Individual Income Tax Return, and Form 1040N-V, Nebraska Individual Income Tax Payment Voucher. These forms can be easily downloaded, filled out, and submitted along with any necessary documentation.

In addition to the standard tax forms, the Nebraska Department of Revenue also provides instructions for each form to help taxpayers accurately report their income and deductions. These instructions can be a valuable resource for individuals who are unfamiliar with the tax filing process or who have specific questions about their tax situation.

By utilizing the printable Nebraska state income tax forms provided by the Department of Revenue, taxpayers can ensure that they are meeting their state tax obligations and avoiding any potential penalties or interest. These forms are designed to be user-friendly and can help simplify the tax filing process for Nebraska residents.

In conclusion, having access to printable Nebraska state income tax forms can make filing your taxes easier and more convenient. By visiting the Nebraska Department of Revenue’s website, taxpayers can download the necessary forms and instructions to accurately report their income and deductions. With the right forms in hand, you can successfully navigate the state tax filing process and ensure compliance with Nebraska tax laws.