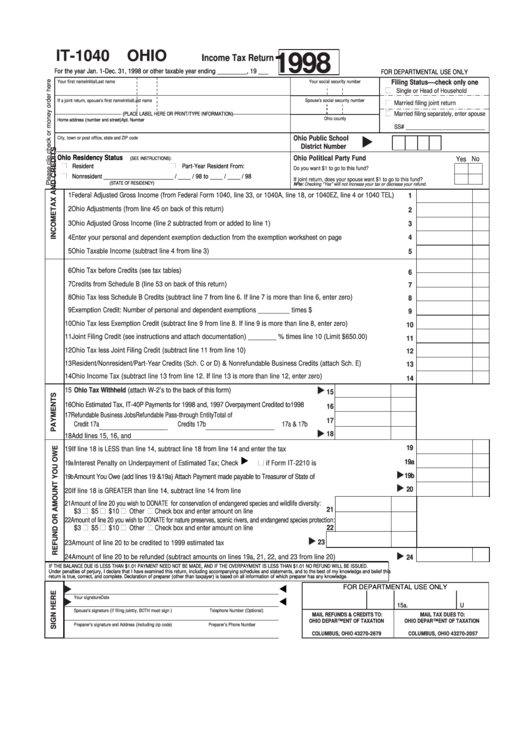

Preparing and filing your taxes can be a daunting task, but having the necessary forms and resources can make the process much smoother. The IT1040 Individual Income Tax form for the year 2016 is an essential document for individuals to report their income and calculate their tax liability for that year.

For taxpayers who prefer to file their taxes on paper rather than electronically, having access to printable forms is crucial. The IT1040 form for 2016 is readily available online for individuals to download, fill out, and submit to the relevant tax authorities.

Printable It1040 Individual Income Tax 2016

Printable It1040 Individual Income Tax 2016

The IT1040 form for 2016 includes sections for taxpayers to report their income, deductions, credits, and calculate their tax liability. It is important for individuals to carefully review the instructions provided with the form to ensure accurate completion and submission.

One of the advantages of using printable forms like the IT1040 for 2016 is the ability to work on them at your own pace and convenience. Taxpayers can take their time to gather all the necessary information and ensure that their tax return is accurate before submitting it.

After completing the IT1040 form for 2016, taxpayers can either mail it to the appropriate tax authority or file it electronically, depending on their preference. It is important to retain a copy of the completed form and any supporting documentation for your records.

Overall, having access to printable forms like the IT1040 for 2016 can make the process of filing taxes easier and more convenient for individuals. By carefully following the instructions and accurately reporting your income and deductions, you can ensure that your tax return is filed correctly and on time.