When tax season rolls around, one of the forms that many individuals need to fill out is the Interest Income Tax Form. This form is used to report any interest income earned throughout the year, whether it be from savings accounts, certificates of deposit, or other interest-bearing accounts. It is important to accurately report this income to ensure compliance with tax laws and avoid any potential penalties.

For those who prefer to fill out their tax forms manually, having a printable version of the Interest Income Tax Form can be extremely helpful. This allows individuals to easily access the form, fill it out at their own pace, and submit it to the IRS in a timely manner. Additionally, having a printable form can make the process less overwhelming for those who may not be as familiar with tax laws and regulations.

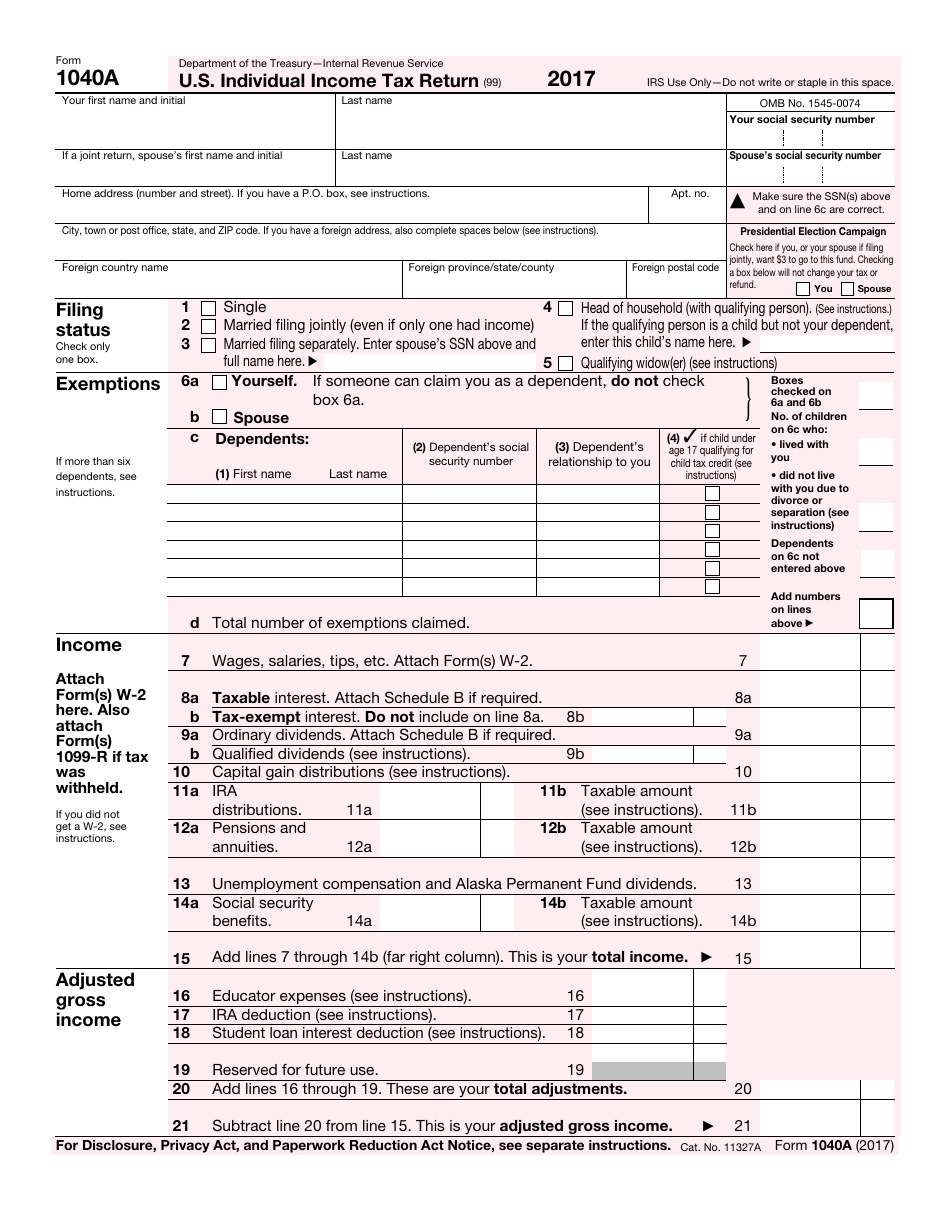

Printable Interest Income Tax Form

Printable Interest Income Tax Form

Printable Interest Income Tax Form

When filling out the printable Interest Income Tax Form, it is important to gather all relevant documents that show the amount of interest earned throughout the year. This can include statements from banks or financial institutions that detail the interest earned on various accounts. Having this information readily available can streamline the process of filling out the form and ensure accuracy.

One key aspect of the Interest Income Tax Form is reporting any interest income earned from foreign accounts. It is important to carefully review the instructions provided with the form to ensure that all foreign interest income is properly reported. Failure to do so could result in penalties or audits by the IRS.

Once the form has been filled out completely, it can be submitted to the IRS either electronically or by mail. It is important to keep a copy of the form for your records in case any issues arise in the future. By accurately reporting interest income on the printable form, individuals can ensure compliance with tax laws and avoid any potential penalties.

In conclusion, having access to a printable Interest Income Tax Form can make the process of reporting interest income much easier and less stressful. By ensuring that all interest income is accurately reported, individuals can avoid potential issues with the IRS and stay in compliance with tax laws. Utilizing the printable form can help individuals stay organized and on top of their tax obligations.