As the tax season approaches, individuals and businesses are gearing up to file their income tax returns. One of the crucial aspects of this process is having the necessary forms to accurately report income, deductions, and credits. In the digital age, many taxpayers prefer the convenience of printable forms that can be easily accessed and filled out from the comfort of their own homes.

Printable income tax forms for the year 2025 are readily available online, making it easier for taxpayers to navigate through the complex tax filing process. These forms are essential for reporting various sources of income, such as wages, dividends, and business earnings, as well as claiming deductions and credits to minimize tax liabilities.

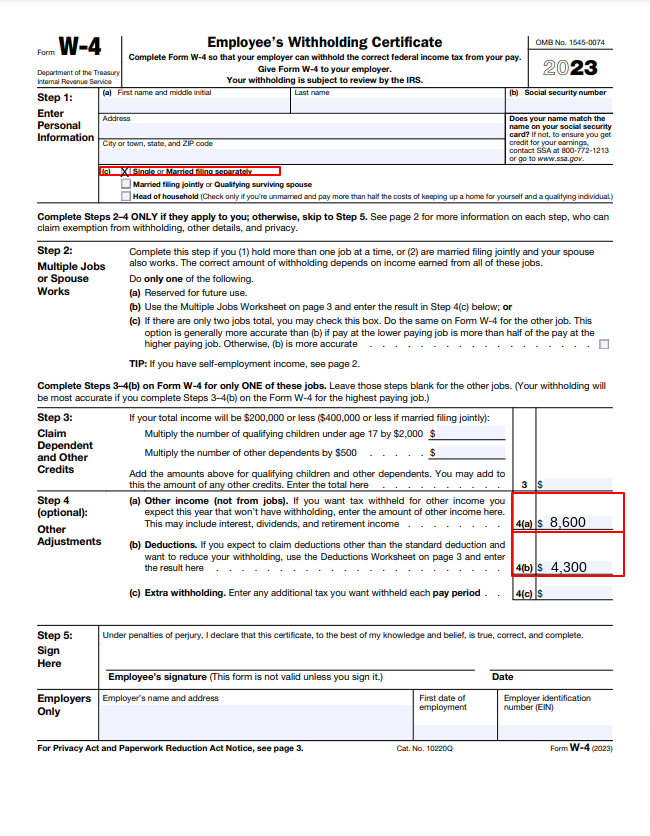

Printable Income Tax Forms 2025

Printable Income Tax Forms 2025

When it comes to filing income taxes, accuracy is key to avoiding potential audits or penalties. Printable income tax forms for 2025 provide a structured format that guides taxpayers through the necessary information they need to report. From personal information to detailed breakdowns of income and expenses, these forms help ensure that taxpayers fulfill their obligations to the government.

One of the advantages of printable income tax forms is the ability to save time and effort. Instead of waiting in long lines at tax offices or struggling to find physical forms, taxpayers can simply download and print the necessary documents from the IRS website or other reputable sources. This streamlines the filing process and allows individuals and businesses to focus on accurately reporting their financial information.

As tax laws and regulations continue to evolve, having access to updated and printable income tax forms is essential for staying compliant with the latest requirements. Whether it’s reporting cryptocurrency transactions, claiming new tax credits, or navigating changes in deductions, having the right forms at your disposal can make a significant difference in ensuring a smooth and error-free filing process.

In conclusion, printable income tax forms for the year 2025 play a crucial role in helping individuals and businesses fulfill their tax obligations. With the convenience and accessibility of online forms, taxpayers can easily navigate through the complexities of the tax filing process and ensure that they accurately report their financial information. By utilizing these resources, taxpayers can streamline their tax filing experience and stay up-to-date with the latest requirements and regulations.