Filing your income taxes can be a stressful and daunting task, but having the right forms can make the process much easier. With the new tax year upon us, it’s important to stay informed about the updated forms and changes that may impact your filing. Fortunately, the IRS provides printable income tax forms for taxpayers to download and use for their filings.

Whether you’re filing as an individual, a business owner, or a freelancer, having access to the necessary forms is crucial for accurately reporting your income and deductions. The 2021 tax year brings some changes to the tax code, so it’s essential to have the most up-to-date forms at your disposal.

Printable Income Tax Forms 2021

Printable Income Tax Forms 2021

Printable Income Tax Forms 2021

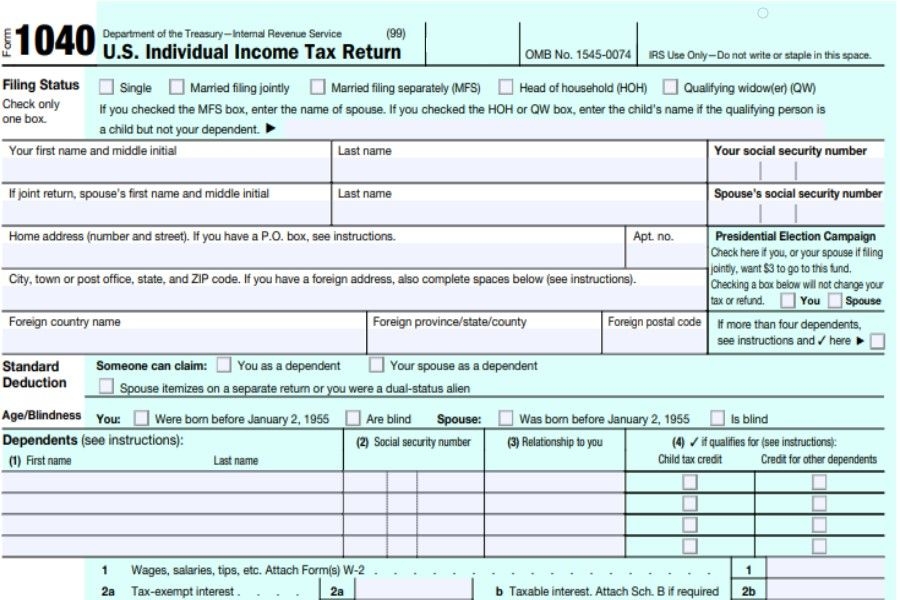

For the 2021 tax year, the IRS has made available a variety of printable income tax forms on their website. These forms cover a range of tax situations, including individual income tax returns (Form 1040), business income tax returns (Form 1120), and self-employment tax returns (Schedule SE).

One of the most common forms that taxpayers will need to file their income taxes is Form 1040. This form is used by individuals to report their income, deductions, and credits for the year. The IRS has updated Form 1040 for the 2021 tax year, so be sure to use the most recent version when filing your taxes.

In addition to Form 1040, there are other supplemental forms that may be required depending on your tax situation. For example, if you’re a freelancer or self-employed individual, you may need to file Schedule C to report your business income and expenses. It’s important to review all necessary forms and instructions before starting your tax return to ensure accuracy.

By utilizing printable income tax forms for the 2021 tax year, you can streamline the filing process and ensure that you’re reporting your income and deductions correctly. These forms are readily available on the IRS website and can be easily downloaded and printed for your convenience.

As the tax filing deadline approaches, make sure you have all the necessary forms and documentation in order to avoid any delays or penalties. Staying organized and informed about the latest tax changes will help you file your income taxes accurately and efficiently.