As tax season approaches, many individuals and businesses are gearing up to file their taxes for the year 2020. One of the essential tasks in this process is obtaining the necessary tax forms to accurately report income, deductions, and credits. Fortunately, the Internal Revenue Service (IRS) provides printable income tax forms online for easy access and convenience.

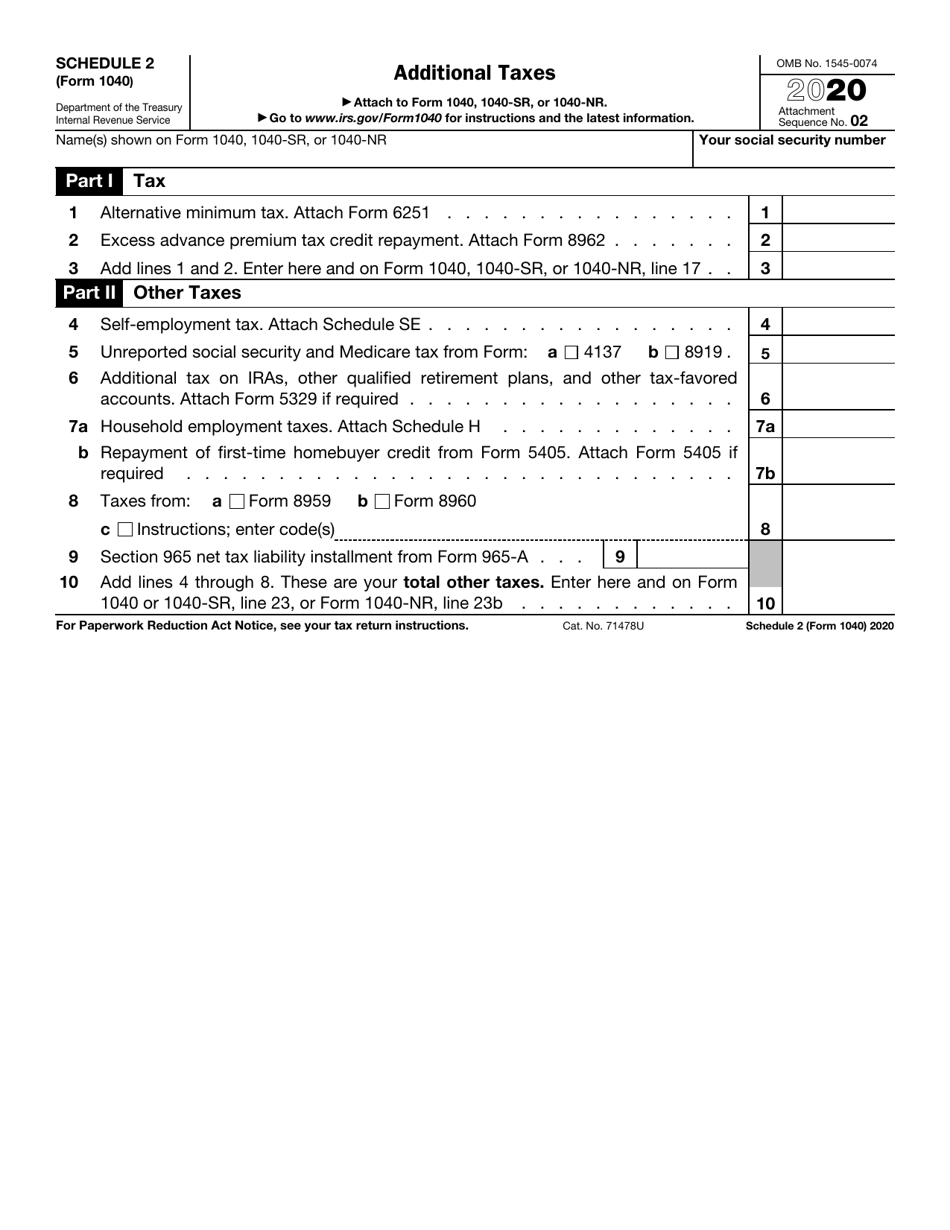

Printable income tax forms for the year 2020 can be easily accessed on the IRS website or through various tax preparation software platforms. These forms include essential documents like Form 1040, Form 1040-SR for seniors, and various schedules for reporting specific types of income or deductions. By utilizing printable forms, taxpayers can efficiently fill out their tax returns and ensure compliance with tax laws.

Printable Income Tax Forms 2020

Printable Income Tax Forms 2020

When using printable income tax forms, it is crucial to carefully review the instructions provided by the IRS to accurately complete the forms. Taxpayers should gather all necessary documents, such as W-2s, 1099s, and receipts, before starting the filing process. Additionally, individuals and businesses can benefit from utilizing online resources and tools to simplify tax preparation and maximize deductions.

Many taxpayers opt to e-file their tax returns for faster processing and potential refunds. However, printable income tax forms remain a valuable option for those who prefer a more hands-on approach or need physical copies for record-keeping purposes. By downloading and printing the necessary forms, individuals and businesses can take control of their tax filing process and ensure accuracy in reporting financial information.

In conclusion, printable income tax forms for the year 2020 offer a convenient and accessible way for taxpayers to fulfill their filing obligations. Whether you choose to file electronically or prefer traditional paper forms, having the option to print necessary documents makes the tax preparation process more manageable. By utilizing these resources and following IRS guidelines, individuals and businesses can navigate tax season with confidence and peace of mind.