Self-employed individuals have unique tax requirements compared to traditional employees. They must file their income taxes using specific forms to account for their business income and deductions. As the tax season approaches, it is essential for self-employed individuals to be aware of the necessary forms they need to fill out to accurately report their income and expenses to the IRS.

Printable income tax forms for self-employed individuals can be easily accessed online. These forms are designed to capture the various sources of income, deductions, and credits that are relevant to self-employment. By using these forms, self-employed individuals can ensure that their tax returns are filed correctly and in compliance with IRS regulations.

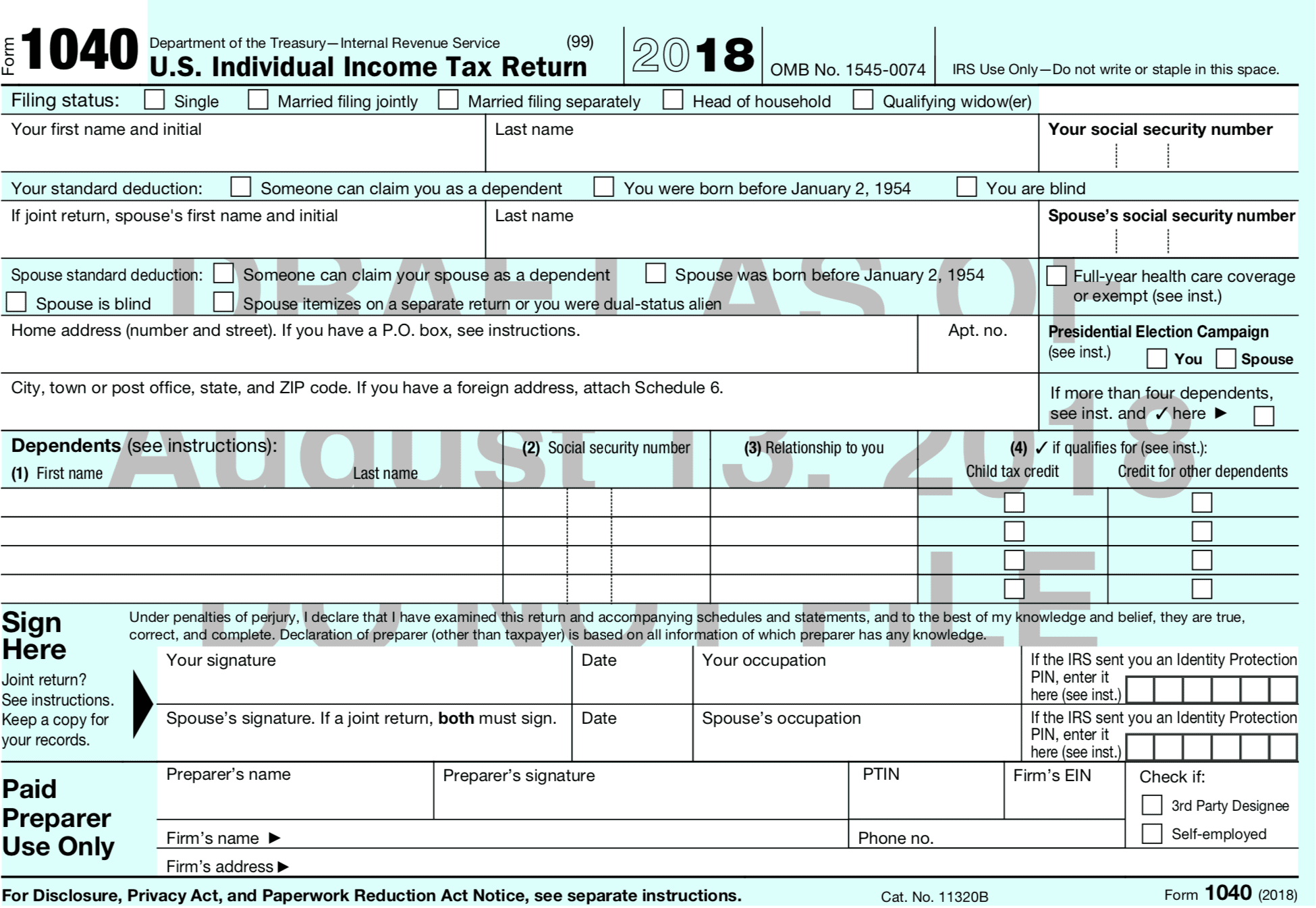

Printable Income Tax Forms 2018 For Self Employed

Printable Income Tax Forms 2018 For Self Employed

One of the most commonly used forms for self-employed individuals is the Schedule C form. This form is used to report business income and expenses, including information on profits or losses from the business. Additionally, self-employed individuals may need to fill out Form 1040, which is the standard individual income tax return form. Other forms, such as Schedule SE for self-employment tax and Form 8829 for business use of the home, may also be required depending on the nature of the business.

It is important for self-employed individuals to keep accurate records of their income and expenses throughout the year to make the tax filing process smoother. By utilizing printable income tax forms for self-employed individuals, they can easily input the necessary information and calculate their tax liability. These forms also provide guidance on which deductions and credits are available to self-employed individuals, helping them maximize their tax savings.

As the tax deadline approaches, self-employed individuals should gather all necessary documents and fill out the required forms to avoid any penalties or fines for late filing. By staying organized and utilizing printable income tax forms for self-employed individuals, they can ensure that their tax returns are filed accurately and on time.

In conclusion, printable income tax forms for self-employed individuals are essential tools for accurately reporting business income and expenses to the IRS. By using these forms, self-employed individuals can streamline the tax filing process and ensure compliance with tax regulations. It is crucial for self-employed individuals to be aware of the specific forms they need to fill out and to keep thorough records of their business activities throughout the year.