As we approach tax season, many individuals and businesses are starting to gather the necessary documents to file their taxes. One important aspect of this process is having the correct tax forms to accurately report income and deductions. In 2017, the IRS provided a variety of printable income tax forms to make the filing process easier for taxpayers.

Printable income tax forms for 2017 can be found on the IRS website or through various online tax preparation services. These forms are essential for individuals and businesses to report their income, deductions, and credits accurately. Having the right forms on hand can help streamline the tax filing process and ensure that all necessary information is included.

Printable Income Tax Forms 2017

Printable Income Tax Forms 2017

One of the most commonly used forms for individual taxpayers is the Form 1040, which is used to report income, deductions, and credits for the year. This form is available for download and printing on the IRS website, along with instructions on how to fill it out correctly. Additionally, there are other forms such as the 1099 series for reporting various types of income like interest, dividends, and self-employment earnings.

For businesses, the IRS provides printable forms such as the Form 1120 for corporations and Form 1065 for partnerships. These forms are crucial for reporting income, deductions, and credits for the tax year. By having these forms readily available, businesses can ensure that they are accurately reporting their financial information to the IRS.

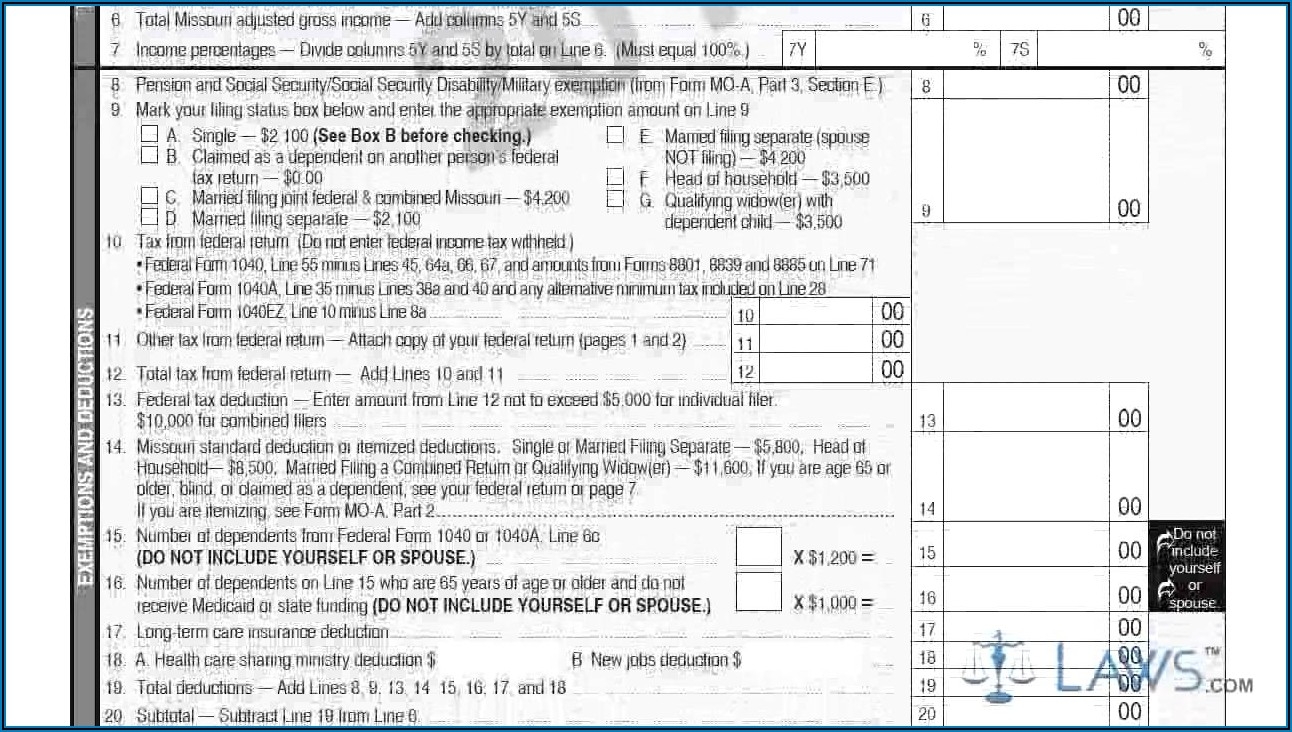

In addition to federal tax forms, many states also provide printable income tax forms for taxpayers to report their state income tax liability. These forms can usually be found on the website of the state’s department of revenue or taxation. It is important for taxpayers to use the correct forms for both federal and state taxes to avoid any errors in reporting.

Overall, having access to printable income tax forms for 2017 is essential for individuals and businesses to accurately report their financial information to the IRS. By using the correct forms and following the instructions provided, taxpayers can ensure a smooth tax filing process and avoid any potential penalties for incorrect reporting.