When it comes to filing your taxes, one of the most commonly used forms is the 1040ez. This form is designed for taxpayers with simple tax situations and allows them to easily report their income, claim deductions, and calculate their tax liability. The 1040ez is a great option for those who do not have many deductions or credits to claim, as it is a simplified version of the more complex 1040 form.

One of the main benefits of using the 1040ez form is that it is easy to understand and fill out. The form only requires basic information such as your income, filing status, and any taxes that have already been withheld. This makes it a quick and straightforward option for those who do not want to spend a lot of time on their taxes.

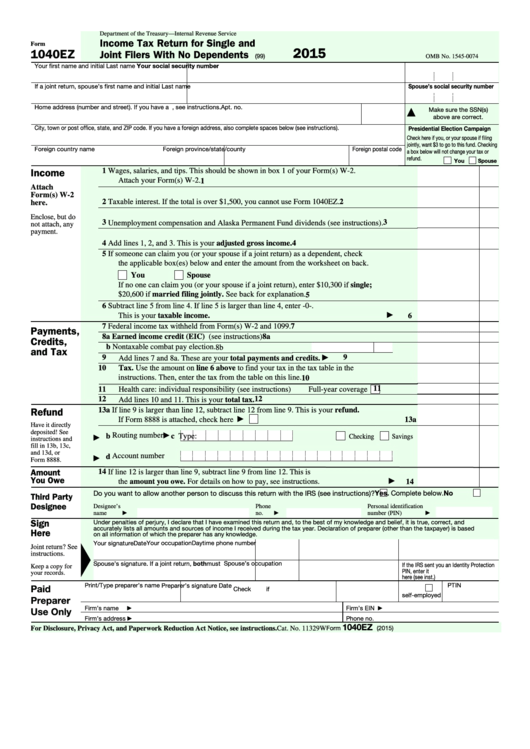

Printable Income Tax Form 1040ez

Printable Income Tax Form 1040ez

When using the 1040ez form, it is important to make sure that you meet all the eligibility requirements. For example, you must have a taxable income of less than $100,000, be under the age of 65, and not have any dependents. If you meet these criteria, you can download and print a copy of the form from the IRS website or pick one up at your local post office.

Once you have filled out the form, you can either mail it in or file electronically using IRS e-file. If you choose to mail it in, make sure to double-check all the information you have provided and include any necessary documentation. If you file electronically, you will receive a confirmation once your return has been accepted.

In conclusion, the 1040ez form is a simple and convenient option for taxpayers with straightforward tax situations. By using this form, you can quickly and accurately report your income and ensure that you are in compliance with the IRS. If you are eligible to use the 1040ez, be sure to take advantage of this easy-to-use form when filing your taxes.