As the tax season approaches, it is important for taxpayers to have access to the necessary forms to file their federal income taxes. In 2016, the IRS released a variety of printable federal income tax forms to help individuals and businesses accurately report their income and deductions.

These forms are essential for taxpayers to fulfill their obligations to the government and ensure compliance with tax laws. By having access to printable federal income tax forms for the year 2016, individuals can efficiently prepare and submit their tax returns in a timely manner.

Printable Federal Income Tax Forms 2016

Printable Federal Income Tax Forms 2016

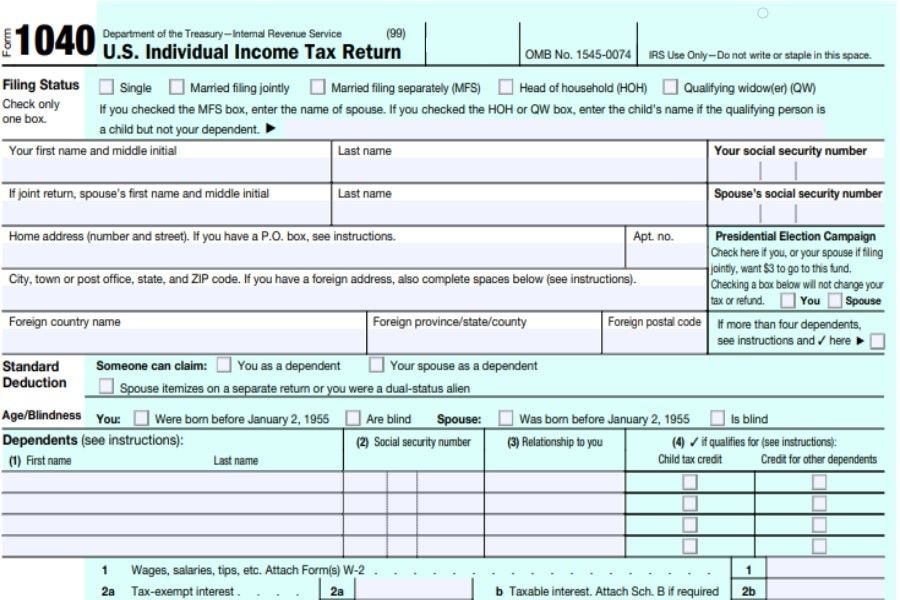

When it comes to filing taxes, accuracy is key. The IRS provides a range of printable federal income tax forms for 2016, including Form 1040, Form 1040A, and Form 1040EZ. These forms cater to different types of taxpayers, from those with simple tax situations to those with more complex financial affairs.

In addition to the standard tax forms, there are also supplemental forms available for specific deductions and credits. Taxpayers can easily access these forms online and print them out for their records. It is important to review the instructions carefully and fill out the forms accurately to avoid any discrepancies or delays in processing.

By utilizing printable federal income tax forms for the year 2016, taxpayers can streamline the tax filing process and ensure that they are in compliance with federal tax laws. These forms provide a convenient and accessible way for individuals and businesses to report their income, deductions, and credits accurately.

As tax season approaches, it is crucial for taxpayers to gather the necessary documents and forms to file their federal income taxes. By utilizing printable federal income tax forms for 2016, individuals can effectively report their financial information and meet their tax obligations.