As tax season approaches, many individuals and businesses are gearing up to file their federal income tax returns. One crucial aspect of this process is obtaining the necessary tax forms to accurately report income, deductions, and credits. Fortunately, the Internal Revenue Service (IRS) provides printable federal income tax forms that can be easily accessed and filled out by taxpayers.

Printable federal income tax forms are essential documents that individuals and businesses use to report their annual income and calculate the amount of taxes owed to the government. These forms typically include sections for personal information, income sources, deductions, and credits. By accurately completing these forms, taxpayers can ensure that they are in compliance with federal tax laws and avoid potential penalties or audits.

Printable Federal Income Tax Forms

Printable Federal Income Tax Forms

Printable Federal Income Tax Forms

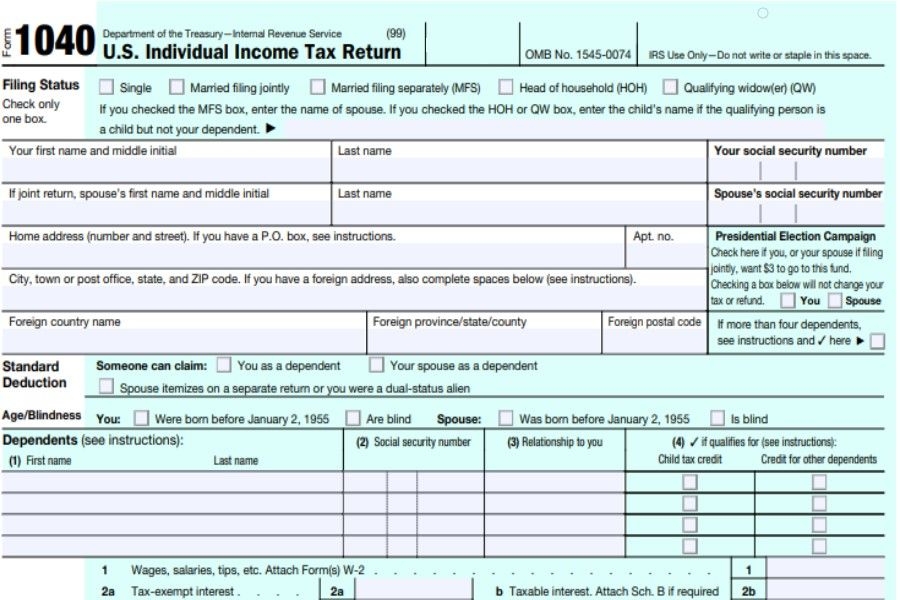

There are several common federal income tax forms that individuals may need to file their taxes, including Form 1040, Form 1040A, and Form 1040EZ. Form 1040 is the most comprehensive form and is used by individuals with more complex tax situations, while Form 1040A and Form 1040EZ are simplified versions for those with less complicated tax affairs.

Additionally, businesses may need to file Form 1120 for corporations, Form 1065 for partnerships, or Schedule C for self-employed individuals. These forms require detailed information about the business’s income, expenses, and deductions, so it is essential to carefully review the instructions and fill them out accurately.

Printable federal income tax forms can be downloaded from the IRS website or obtained from local tax preparation offices. Many online tax preparation services also offer printable forms that can be filled out electronically and submitted directly to the IRS. It is essential to double-check all information entered on the forms to ensure accuracy and prevent errors that could delay the processing of the tax return.

In conclusion, printable federal income tax forms are essential tools that individuals and businesses use to report their annual income and calculate the amount of taxes owed to the government. By understanding the various types of tax forms available and accurately completing them, taxpayers can ensure compliance with federal tax laws and avoid potential penalties. Be sure to gather all necessary documents and information before filling out your tax forms to streamline the filing process and minimize errors.