Filing your federal income taxes can be a daunting task, but having the right forms and resources can make the process much easier. One popular form that many taxpayers use is the Form 1040a, which is a simplified version of the standard Form 1040. This form is designed for individuals with less complex tax situations and can help you calculate your tax liability quickly and accurately.

With the availability of printable federal income tax Form 1040a, you can easily access and fill out the form from the comfort of your own home. This can save you time and money compared to purchasing a physical copy or hiring a professional tax preparer. By utilizing printable forms, you can ensure that your tax return is submitted on time and without any errors.

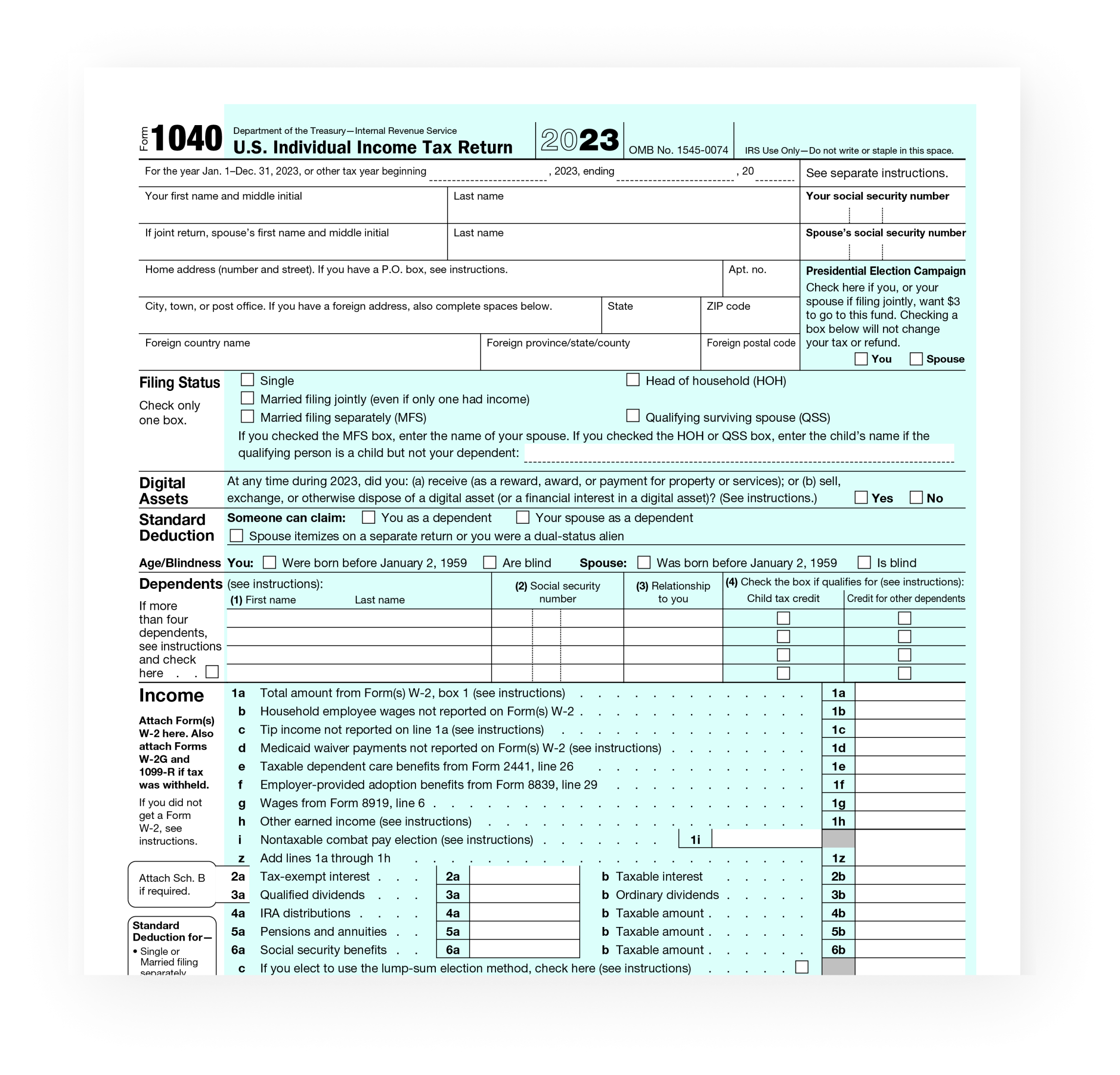

Printable Federal Income Tax Form 1040a

Printable Federal Income Tax Form 1040a

Completing Form 1040a is relatively straightforward, as it only requires basic information such as income, deductions, and credits. This form is ideal for individuals who do not have significant investments or self-employment income, making it a popular choice for many taxpayers. By following the instructions provided with the form, you can accurately report your financial information and calculate your tax liability.

When using printable federal income tax Form 1040a, it is important to double-check your entries and ensure that all information is accurate and up-to-date. Mistakes on your tax return can lead to delays in processing or even penalties from the IRS, so taking the time to review your form carefully is essential. Additionally, be sure to include any necessary supporting documentation, such as W-2 forms or receipts, to substantiate your claims.

Overall, printable federal income tax Form 1040a provides a convenient and efficient way to file your taxes without the need for professional assistance. By utilizing this form, you can take control of your tax return and ensure that you are meeting your obligations as a taxpayer. Whether you are filing as an individual or a married couple, Form 1040a offers a simplified approach to reporting your income and deductions, making the tax-filing process much more manageable.

In conclusion, having access to printable federal income tax Form 1040a can streamline the tax-filing process and help you accurately report your financial information. By utilizing this form and following the instructions provided, you can ensure that your tax return is submitted correctly and on time. Take advantage of printable forms to take control of your taxes and avoid costly mistakes.