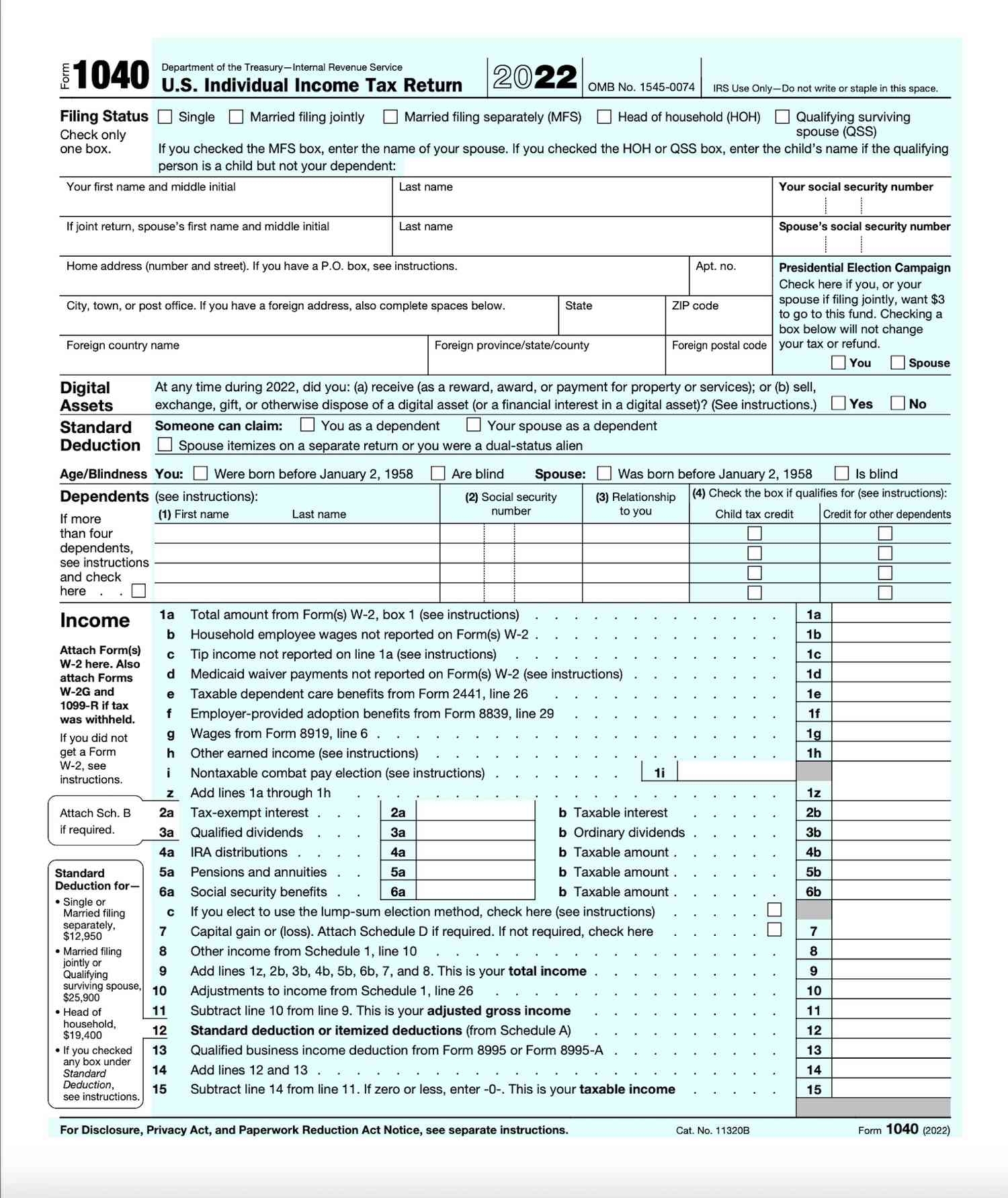

Filing taxes is a necessary task for individuals and businesses to fulfill their legal obligations to the government. The Federal Income Tax Form 1040 is one of the most common forms used by individuals to report their annual income and calculate the amount of tax owed to the IRS.

Completing the Form 1040 can be a daunting task for some taxpayers, but having a printable version of the form can make the process easier and more convenient. With a printable Form 1040, taxpayers can fill out the form at their own pace and have a physical copy for their records.

Printable Federal Income Tax Form 1040

Printable Federal Income Tax Form 1040

When filling out the Form 1040, taxpayers will need to provide information about their income, deductions, credits, and any taxes already paid. This form is used to calculate the taxpayer’s total tax liability or refund for the year.

It is important for taxpayers to accurately report their income and expenses on the Form 1040 to avoid any potential penalties or audits from the IRS. Using a printable version of the form can help taxpayers organize their information and ensure they are completing the form correctly.

Once the Form 1040 is completed, taxpayers can either file the form electronically or mail it to the IRS. It is crucial to submit the form by the deadline, which is typically April 15th of each year, unless an extension has been granted.

Overall, having access to a printable Federal Income Tax Form 1040 can simplify the tax-filing process for individuals and ensure they are meeting their obligations to the government. By accurately completing the form and submitting it on time, taxpayers can avoid potential issues with the IRS and ensure they are in compliance with tax laws.