Arkansas residents who need to file their state income taxes can easily access printable forms online. These forms are essential for individuals and businesses to report their income, deductions, and credits accurately to the Arkansas Department of Finance and Administration.

By utilizing printable Arkansas income tax forms, taxpayers can conveniently fill out the necessary information, calculate their tax liability, and submit their returns on time. This ensures compliance with state tax laws and helps avoid penalties for late filing or inaccuracies.

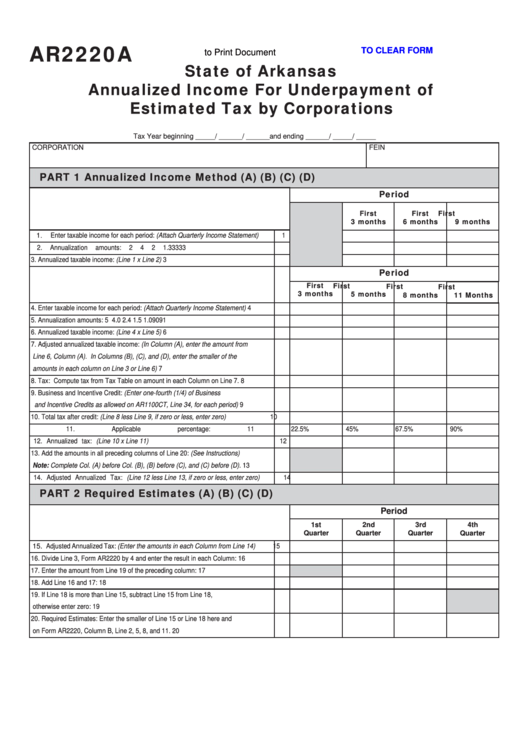

Printable Arkansas Income Tax Forms

Printable Arkansas Income Tax Forms

Accessing Printable Forms

Arkansas residents can visit the official website of the Arkansas Department of Finance and Administration to access printable income tax forms. These forms are available in PDF format, which can be easily downloaded, printed, and filled out manually.

Alternatively, taxpayers can also use online tax preparation software to fill out their forms electronically and file their returns online. This method is convenient and can help minimize errors in calculations or missing information.

It is essential for taxpayers to review the instructions provided with the printable forms to ensure they are completing them accurately. Any mistakes or omissions can lead to delays in processing or potential audits by the tax authorities.

After completing the forms, taxpayers must submit them along with any required documentation and payment by the deadline specified by the Arkansas Department of Finance and Administration. Failure to file on time can result in penalties and interest charges on any outstanding tax liabilities.

Overall, utilizing printable Arkansas income tax forms is a convenient and efficient way for residents to fulfill their tax obligations. By following the instructions carefully and submitting the forms on time, taxpayers can ensure compliance with state tax laws and avoid any potential issues with the tax authorities.

In conclusion, printable Arkansas income tax forms are essential tools for individuals and businesses to report their income and pay their state taxes accurately. By accessing these forms online and following the provided instructions, taxpayers can fulfill their obligations and avoid penalties for non-compliance.