When tax season rolls around, it’s important to have all the necessary forms ready to file your state income taxes. In Alabama, residents are required to file their state income tax returns by the April deadline each year. To make the process easier, the Alabama Department of Revenue provides printable forms that can be easily accessed and filled out.

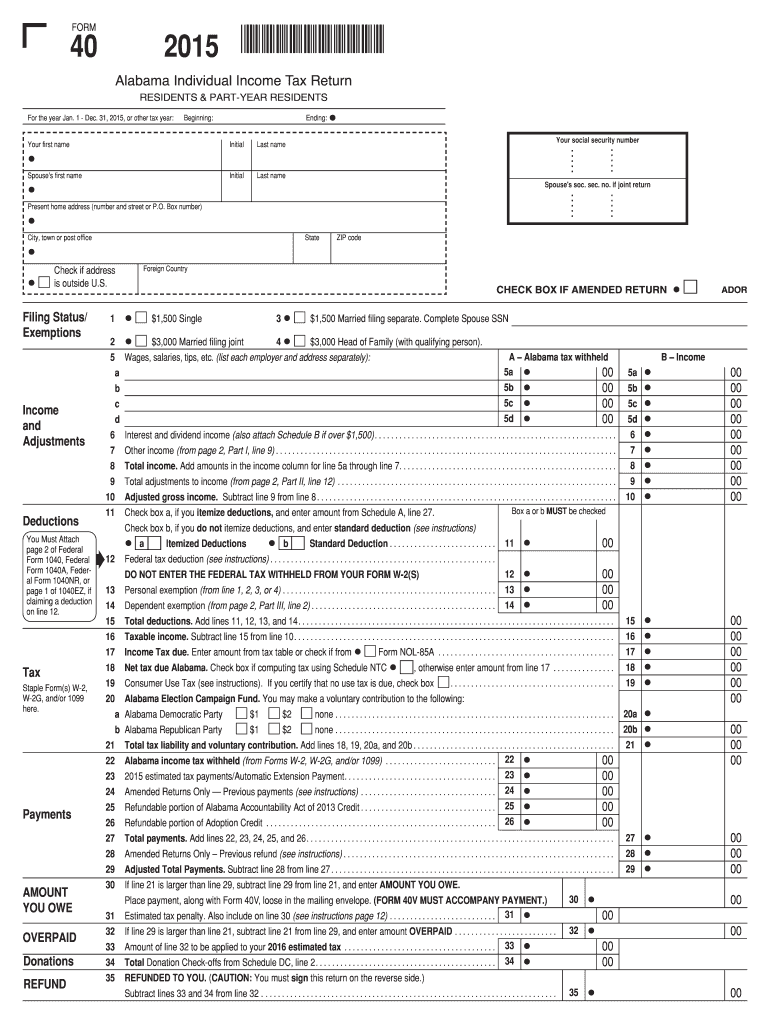

Whether you’re a full-time resident, part-time resident, or nonresident of Alabama, you’ll need to file a state income tax return if you earned income in the state. The printable forms available on the Alabama Department of Revenue website include the Alabama Form 40 for full-year residents, Form 40NR for nonresidents, and Form 40A for part-year residents. These forms are essential for reporting your income, deductions, and credits accurately.

Printable Alabama State Income Tax Forms

Printable Alabama State Income Tax Forms

Before filling out the forms, it’s important to gather all the necessary documentation, such as W-2s, 1099s, and receipts for deductions. Once you have all your paperwork in order, you can easily access the printable forms on the Alabama Department of Revenue website. These forms can be downloaded, printed, and filled out manually, or you can use software programs to file electronically for a faster and more convenient process.

When completing the forms, make sure to double-check all the information for accuracy and completeness. Any errors or missing information could delay your refund or result in penalties. Once you’ve completed the forms, you can either mail them to the Alabama Department of Revenue or file electronically through their website. Make sure to keep a copy of your tax return for your records.

Overall, having access to printable Alabama state income tax forms makes the filing process more straightforward and efficient. By following the guidelines provided by the Alabama Department of Revenue and ensuring all necessary documentation is included, you can successfully file your state income taxes and avoid any potential issues. Remember to file by the deadline and reach out to the department if you have any questions or need assistance with your tax return.