When tax season rolls around, it’s important to have all the necessary forms and documents in order to accurately file your taxes. For residents of Alabama in 2014, having access to printable income tax forms is essential for completing their tax returns.

Printable Alabama Income Tax Forms 2014 provide individuals with the necessary paperwork to report their income, deductions, and credits for the tax year. These forms are easily accessible online and can be downloaded and printed for convenience.

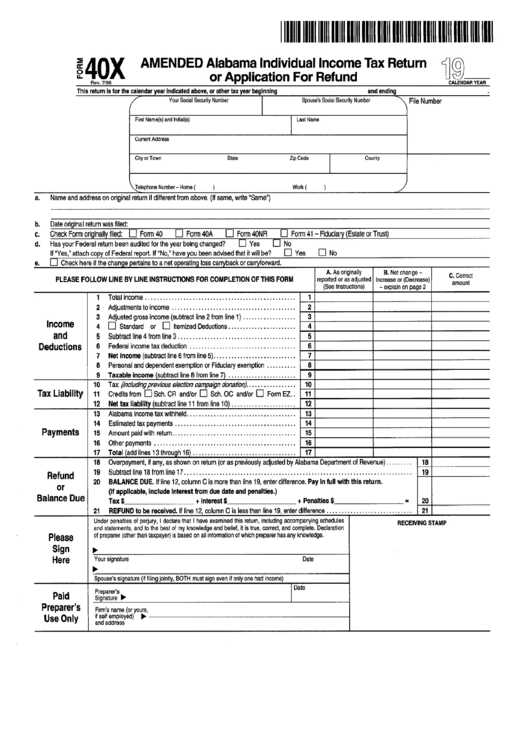

Printable Alabama Income Tax Forms 2014

Printable Alabama Income Tax Forms 2014

One of the key forms that Alabama residents will need to fill out is the Form 40, which is the Alabama Individual Income Tax Return. This form is used to report an individual’s income, deductions, and credits for the tax year. Additionally, residents may need to fill out other forms depending on their specific tax situation.

Other common forms that may be needed include the Schedule A, which is used to itemize deductions, and the Schedule CR, which is used to claim any tax credits that may apply. By having access to these printable forms, individuals can ensure that they are accurately reporting their income and claiming any deductions or credits that they are eligible for.

It’s important for Alabama residents to carefully review the instructions for each form to ensure that they are filling them out correctly. Filing taxes can be a complex process, so having the necessary forms and guidance is crucial for a successful tax return.

By utilizing Printable Alabama Income Tax Forms 2014, residents can take the necessary steps to ensure that their tax returns are filed accurately and on time. These forms provide a convenient way for individuals to report their income and claim any deductions or credits that they are eligible for, making the tax filing process as smooth as possible.

Overall, having access to Printable Alabama Income Tax Forms 2014 is essential for residents to successfully file their taxes and fulfill their obligations to the state. By utilizing these forms and following the instructions carefully, individuals can ensure that they are meeting their tax obligations and avoiding any potential issues with the IRS.