When it comes to filing your taxes in Alabama, having the right forms is essential. One of the most commonly used forms is the AL Income Tax Form 40 3018. This form is used by residents of Alabama to report their income, deductions, and credits for the tax year.

Printable versions of this form are readily available online, making it easy for taxpayers to access and fill out at their convenience. Whether you prefer to file your taxes electronically or by mail, having a printable version of the form can simplify the process and ensure that you accurately report all necessary information.

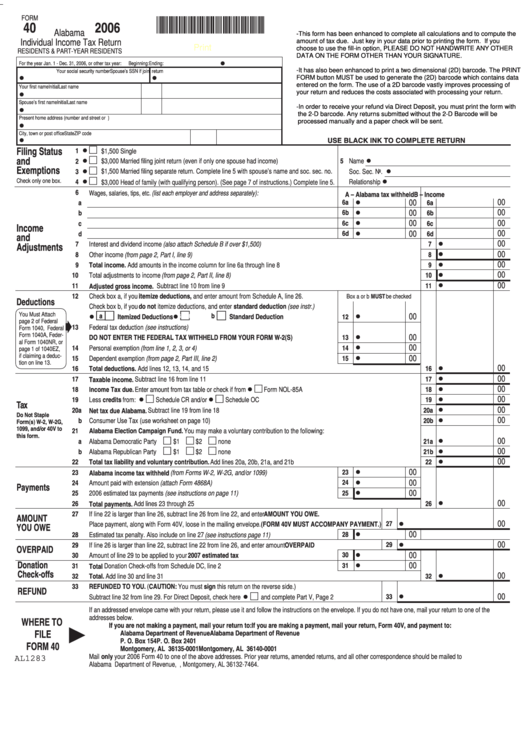

Printable Al Income Tax Form 40 3018

Printable Al Income Tax Form 40 3018

When filling out the AL Income Tax Form 40 3018, taxpayers will need to provide details about their income, including wages, salaries, tips, and other sources of earnings. They will also need to report any deductions they are eligible for, such as mortgage interest, charitable contributions, and student loan interest.

In addition to income and deductions, taxpayers will also need to report any tax credits they are eligible for, which can help reduce the amount of tax owed. Common tax credits in Alabama include the Child and Dependent Care Credit, the Earned Income Tax Credit, and the Education Credit.

Once the form is completed, taxpayers can either file electronically through the Alabama Department of Revenue’s e-filing system or mail a printed copy to the department. It’s important to double-check all information before submitting to ensure accuracy and prevent any delays in processing.

Overall, having access to a printable version of the AL Income Tax Form 40 3018 can streamline the tax filing process for residents of Alabama. By accurately reporting income, deductions, and credits, taxpayers can ensure they are in compliance with state tax laws and avoid any penalties or interest charges.

Closing paragraph

So, if you’re a resident of Alabama getting ready to file your taxes, be sure to download a printable version of the AL Income Tax Form 40 3018 to make the process as smooth as possible. By providing all the necessary information and submitting your form on time, you can fulfill your tax obligations and avoid any potential issues with the state tax authorities.