As the tax season approaches, many individuals and businesses are gearing up to file their taxes for the year 2020. One of the essential steps in this process is obtaining the necessary tax forms to report income and deductions accurately. The Internal Revenue Service (IRS) provides a range of printable 2020 federal income tax forms that can be easily accessed online.

These forms are crucial for individuals and businesses to report their income, deductions, credits, and other financial information to the IRS. Whether you are a salaried employee, a freelancer, a small business owner, or a corporation, there are specific forms that you need to fill out to comply with federal tax laws. By using the printable 2020 federal income tax forms provided by the IRS, you can ensure that you are accurately reporting your financial information and avoiding any potential penalties or audits.

Printable 2020 Federal Income Tax Forms

Printable 2020 Federal Income Tax Forms

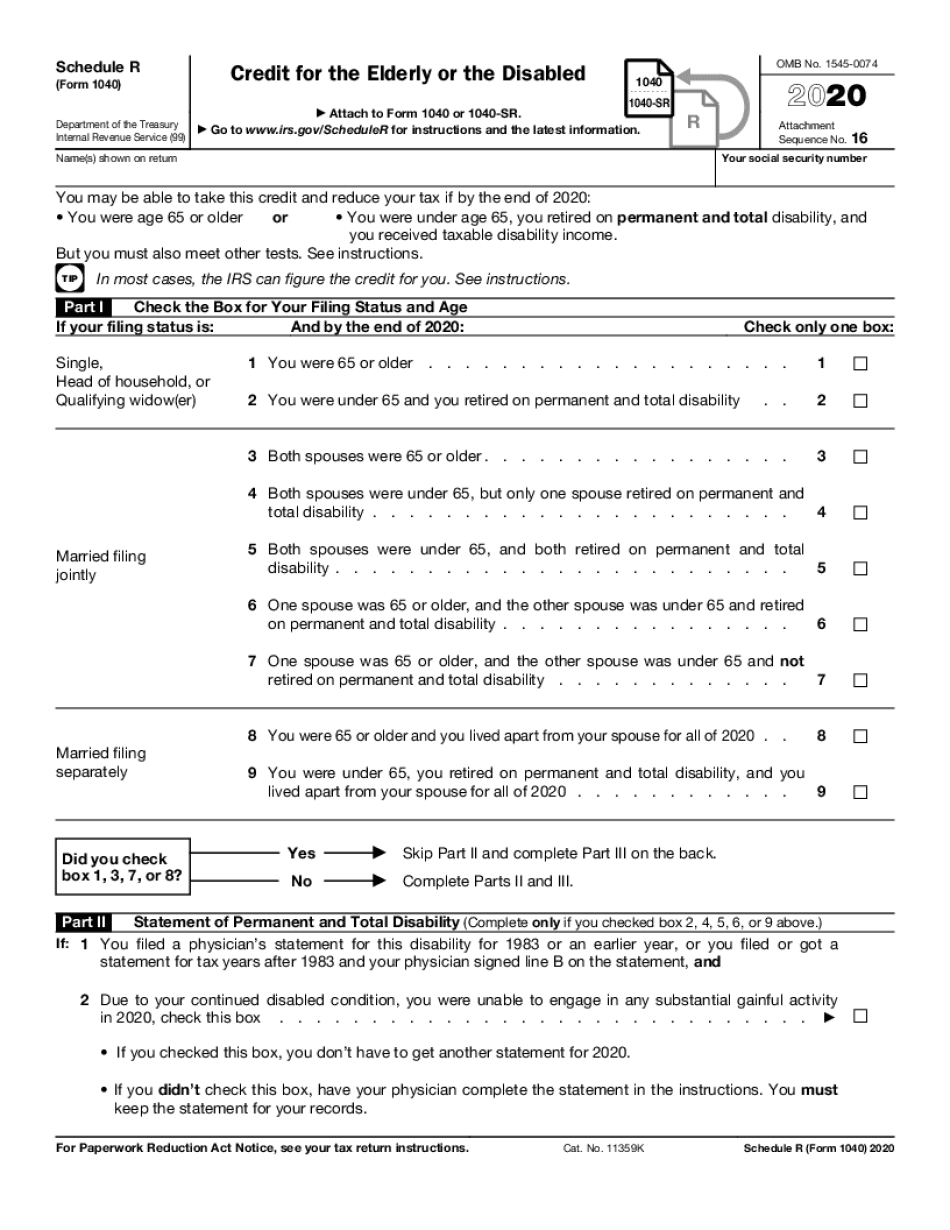

One of the most commonly used tax forms is the Form 1040, which is used by individuals to report their annual income and claim deductions and credits. Additionally, there are various schedules and worksheets that may need to be filed along with the Form 1040, depending on the individual’s financial situation. For businesses, there are different forms such as the Form 1120 for corporations and the Form 1065 for partnerships.

It is important to note that the IRS has made significant changes to tax forms and schedules for the year 2020, so it is crucial to use the updated versions of the forms when filing your taxes. By accessing the printable 2020 federal income tax forms on the IRS website, you can ensure that you are using the most current forms and avoiding any potential errors in your tax return.

In conclusion, obtaining and using the printable 2020 federal income tax forms provided by the IRS is essential for individuals and businesses to accurately report their financial information and comply with federal tax laws. By using these forms, you can ensure that you are filing your taxes correctly and avoiding any potential issues with the IRS. So, make sure to download the necessary forms and schedules for the year 2020 and file your taxes on time to avoid any penalties.