As tax season approaches, Canadians are gearing up to file their income taxes for the year 2020. In order to accurately report their income and deductions, taxpayers will need to have the necessary forms on hand. Fortunately, the Canada Revenue Agency (CRA) provides printable 2020 Canadian income tax forms on their website for easy access.

These forms are essential for individuals and businesses to report their income, claim deductions, and calculate their tax liability. Whether you are a salaried employee, self-employed individual, or a corporation, having the right forms is crucial in meeting your tax obligations and avoiding penalties.

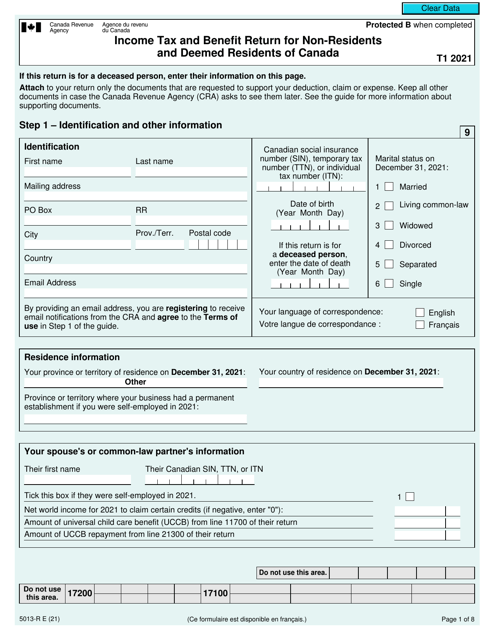

Printable 2020 Canadian Income Tax Forms

Printable 2020 Canadian Income Tax Forms

One of the most commonly used forms is the T1 General Income Tax and Benefit Return, which is used by individuals to report their income, deductions, and tax credits. Other important forms include the T2 Corporation Income Tax Return for corporations, and various schedules for claiming specific deductions or credits.

It is important to ensure that you are using the correct forms for your specific situation, as using the wrong form can result in errors in your tax return. The CRA website provides a comprehensive list of all available forms, along with instructions on how to fill them out correctly.

By utilizing the printable 2020 Canadian income tax forms provided by the CRA, taxpayers can streamline the process of filing their taxes and ensure that they are meeting all their tax obligations. These forms are designed to help individuals and businesses accurately report their income and claim the deductions and credits they are entitled to.

In conclusion, having access to printable 2020 Canadian income tax forms is essential for taxpayers to fulfill their tax obligations. By using the correct forms and accurately reporting their income, individuals and businesses can avoid penalties and ensure compliance with tax laws. Visit the CRA website to download the necessary forms and start preparing your tax return today.