As tax season approaches, it’s important to gather all the necessary forms and documents to file your income taxes accurately and on time. One crucial step in this process is obtaining the correct tax forms for the tax year in question. For the year 2017, there are several printable income tax forms available online that can help simplify the filing process.

Printable tax forms are a convenient option for those who prefer to fill out their tax returns manually or for those who may not have access to tax preparation software. These forms can be easily found on the IRS website or through various other tax preparation websites. Having the necessary forms on hand can save time and ensure that you have all the information needed to complete your tax return accurately.

Printable 2017 Income Taxk Forms

Printable 2017 Income Taxk Forms

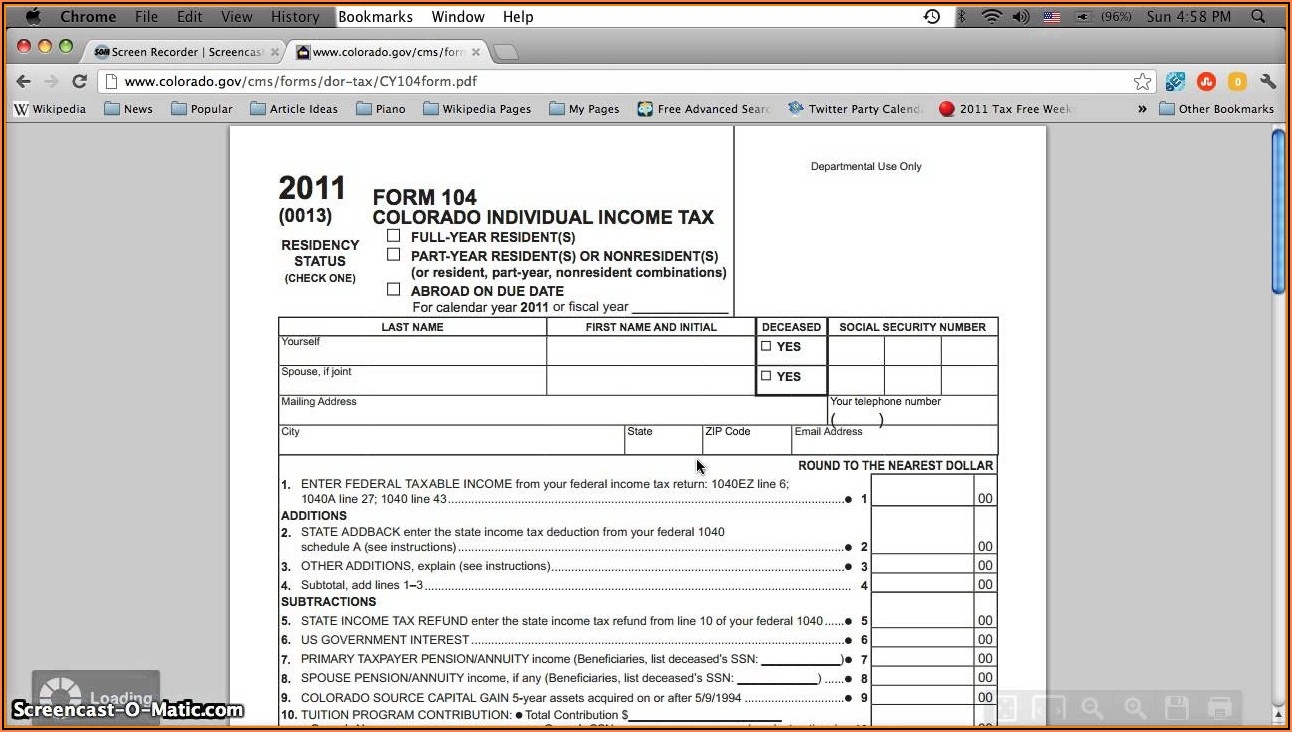

When looking for printable 2017 income tax forms, it’s important to ensure that you are using the correct forms for your specific tax situation. The most common forms for individual taxpayers include Form 1040, Form 1040A, and Form 1040EZ. Each form has specific eligibility requirements and may have different instructions for completion.

In addition to the basic tax forms, there are also various schedules and worksheets that may be required depending on your sources of income and deductions. These additional forms can help you report income from investments, self-employment, rental properties, and other sources. It’s important to review the instructions for each form carefully to ensure that you are providing accurate information.

Before filling out any tax forms, it’s recommended to gather all relevant financial documents, such as W-2s, 1099s, mortgage interest statements, and receipts for deductible expenses. Organizing your paperwork beforehand can help streamline the filing process and minimize errors. Once you have all the necessary forms and documents, you can begin filling out the tax forms and calculating your tax liability.

Overall, printable 2017 income tax forms are a valuable resource for individuals who prefer to file their taxes manually or who may not have access to tax preparation software. By using the correct forms and following the instructions carefully, you can accurately report your income and deductions and ensure that you are meeting your tax obligations. Be sure to file your tax return by the deadline to avoid any penalties or interest charges.