As tax season approaches, it’s important to have all the necessary forms ready to file your income taxes. One common form that many individuals use is the 1040a form, which is used for taxpayers with simple tax situations. This form is shorter and simpler than the standard 1040 form, making it a popular choice for many.

For the year 2017, the 1040a form is still applicable for those who meet the eligibility criteria. It allows taxpayers to claim various deductions and credits, such as the Earned Income Credit, Child Tax Credit, and education credits. It is important to ensure that you are using the correct form for your tax situation to avoid any mistakes or delays in processing.

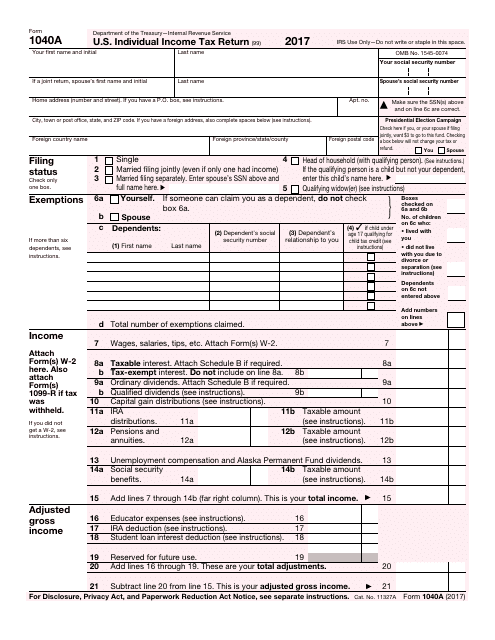

Printable 2017 1040a Income Tax Form

Printable 2017 1040a Income Tax Form

When filling out the 1040a form, taxpayers will need to provide information such as their income, deductions, and credits. This form is designed for individuals with taxable income below $100,000, no dependents, and who do not itemize deductions. It also allows for certain adjustments to income, such as IRA contributions and student loan interest.

One of the benefits of the 1040a form is that it is relatively easy to fill out compared to more complex tax forms. However, it is still important to double-check all information to ensure accuracy. Taxpayers can also use tax software or seek the assistance of a professional tax preparer if needed.

Overall, the Printable 2017 1040a Income Tax Form is a useful tool for individuals with simple tax situations. By having all the necessary information ready and filling out the form accurately, taxpayers can ensure a smooth tax filing process. Remember to file your taxes on time to avoid any penalties or interest charges.

Get your Printable 2017 1040a Income Tax Form here.