Filing taxes can be a daunting task, but having the right forms can make the process much simpler. The Printable 2016 IA 1040 Iowa Individual Income Tax Form is a valuable tool for residents of Iowa to accurately report their income and calculate any taxes owed.

Whether you are self-employed, a wage earner, or receive income from other sources, the IA 1040 form is designed to capture all types of income and deductions to ensure you are paying the correct amount of taxes to the state of Iowa.

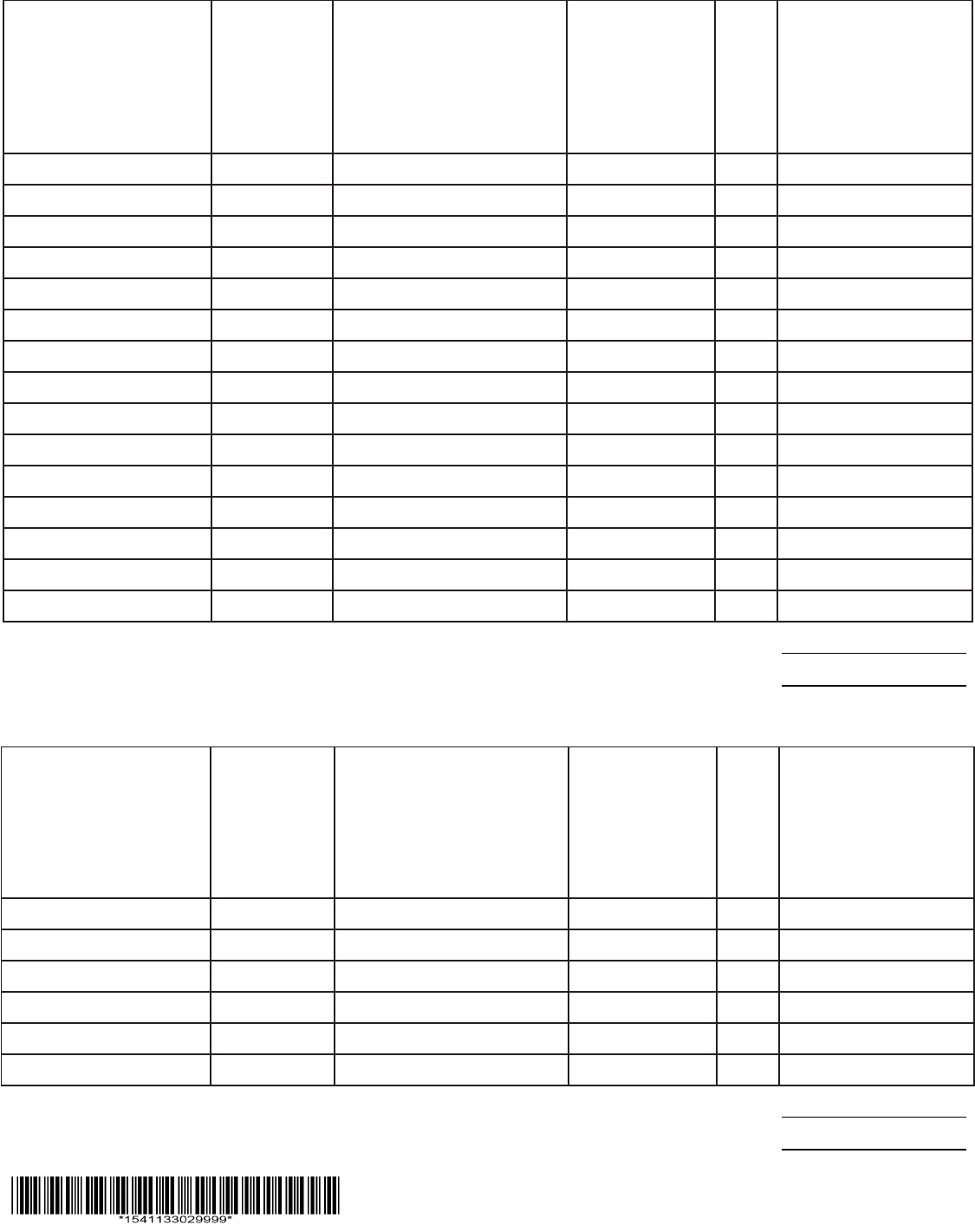

Printable 2016 Ia 1040 Iowa Individual Income Tax Form

Printable 2016 Ia 1040 Iowa Individual Income Tax Form

Completing the IA 1040 form requires attention to detail and accuracy. It is important to gather all necessary documentation, such as W-2s, 1099s, and receipts for deductions, before beginning the filing process. The form includes sections for reporting income, deductions, credits, and calculating the final tax liability.

One of the benefits of using the Printable 2016 IA 1040 Iowa Individual Income Tax Form is the convenience of being able to fill it out online and print it for submission. This eliminates the need to visit a tax office or wait for forms to be mailed to you, saving you time and hassle during tax season.

After completing the form, be sure to double-check all entries for accuracy before submitting it to the Iowa Department of Revenue. Any errors or omissions could result in delays in processing your return or even trigger an audit by the tax authorities.

In conclusion, the Printable 2016 IA 1040 Iowa Individual Income Tax Form is a valuable resource for residents of Iowa to accurately report their income and pay the correct amount of taxes. By taking the time to fill out the form carefully and accurately, you can ensure a smooth tax filing process and avoid any potential issues with the tax authorities.