When it comes to filing your taxes, having the right forms is essential. The Printable 2014 Ia 1040 Iowa Individual Income Tax Form is a crucial document for residents of Iowa to accurately report their income and deductions for the year.

Whether you are self-employed, a W-2 employee, or have other sources of income, this form will help you navigate the tax filing process and ensure that you are in compliance with state tax laws.

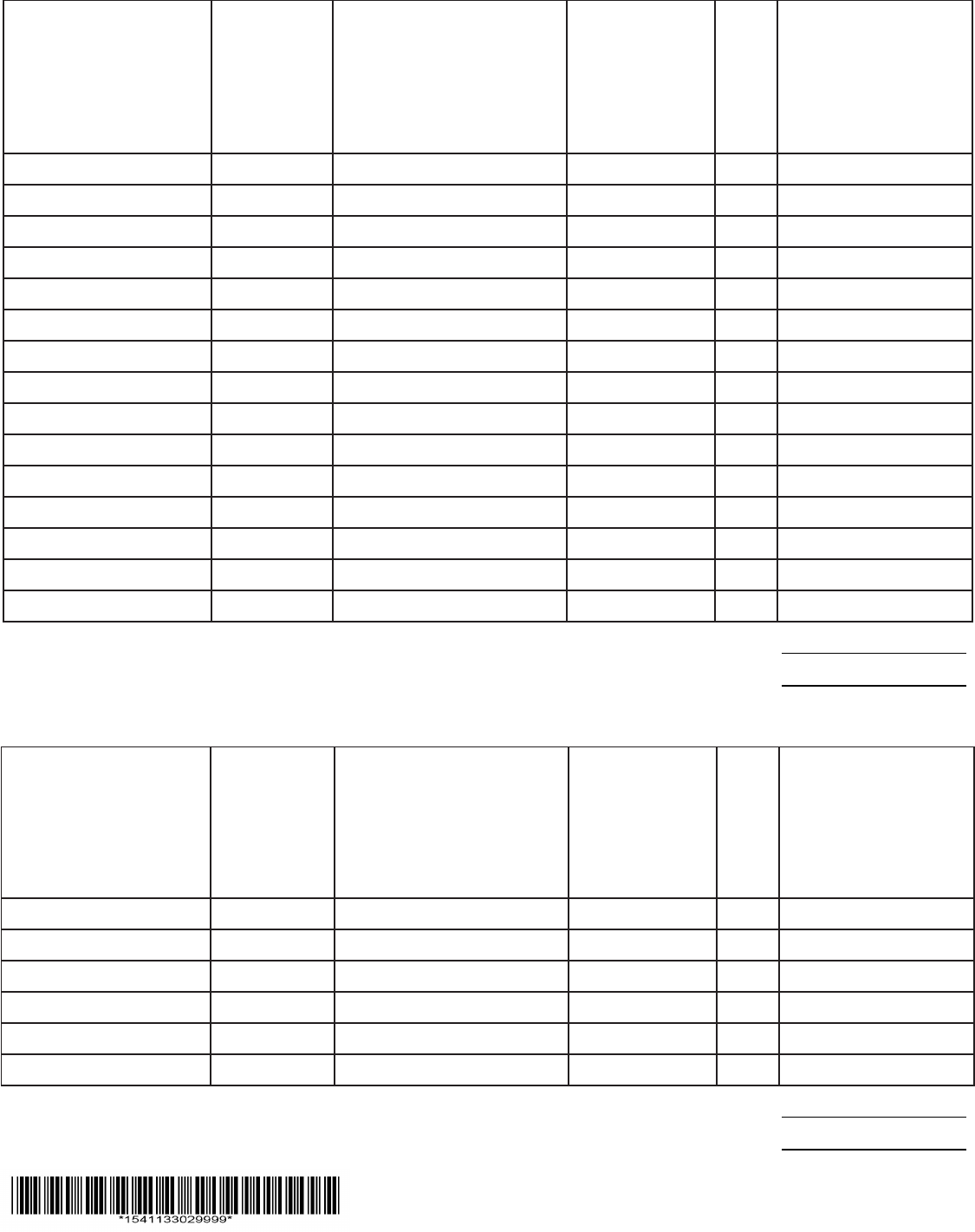

Printable 2014 Ia 1040 Iowa Individual Income Tax Form

Printable 2014 Ia 1040 Iowa Individual Income Tax Form

Completing the Iowa Individual Income Tax Form requires attention to detail and accuracy. You will need to gather information such as your income statements, deductions, and any credits you may be eligible for. This form will help you calculate your tax liability for the year.

It is important to note that the 2014 version of this form may have specific instructions and requirements that differ from more recent years. Be sure to carefully review the guidelines provided with the form to avoid any errors or delays in processing your tax return.

Once you have completed the form, you can file it electronically or mail it to the Iowa Department of Revenue. Be sure to keep a copy for your records and follow up to ensure that your return has been received and processed.

Overall, the Printable 2014 Ia 1040 Iowa Individual Income Tax Form is a valuable tool for Iowa residents to fulfill their tax obligations and accurately report their income. By following the instructions and filling out the form correctly, you can ensure a smooth tax filing process and avoid any potential issues with the IRS.

Take the time to carefully review the form and gather all necessary documentation to accurately report your income and deductions. By doing so, you can maximize your tax refund or minimize any tax liability you may owe to the state of Iowa.

So, if you are an Iowa resident looking to file your taxes for the 2014 tax year, be sure to download and use the Printable Ia 1040 Iowa Individual Income Tax Form to help streamline the process and ensure compliance with state tax laws.