Are you a freelancer or independent contractor who receives miscellaneous income throughout the year? If so, you may need to report this income on your taxes using a 1099-MISC form. This form is used to report income that is not subject to withholding, such as payments for services performed for a business or rental income.

It’s important to accurately report your miscellaneous income to the IRS to avoid penalties or fines. One way to make this process easier is by using a printable 1099-MISC form. These forms can be easily downloaded and printed from the IRS website, making it simple to report your income accurately and on time.

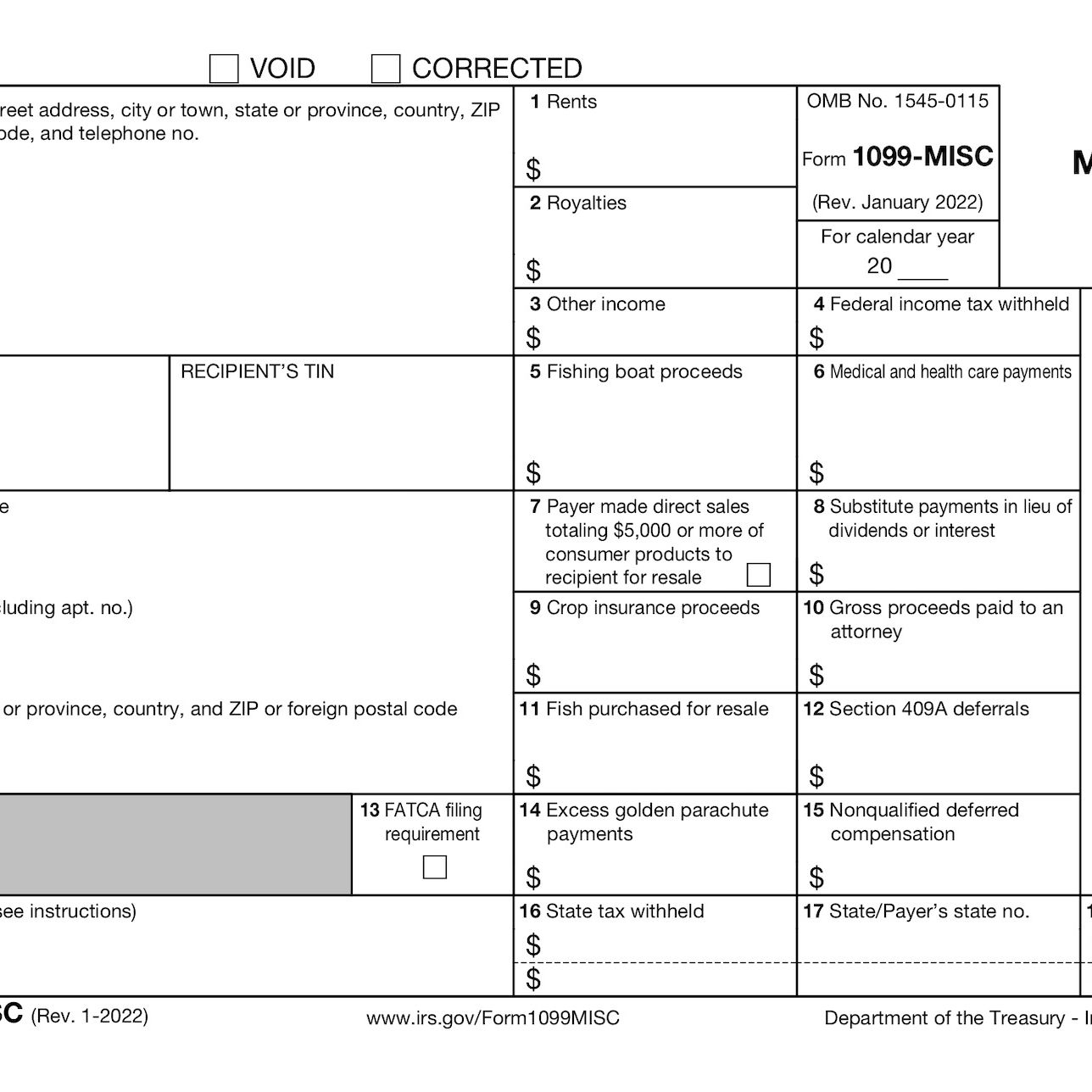

Printable 1099 Miscellaneous Income Form

Printable 1099 Miscellaneous Income Form

When filling out your 1099-MISC form, be sure to include all relevant information, such as your name, address, and Social Security number, as well as the payer’s information and the amount of income received. You may also need to report any federal or state tax withheld from your payments.

Once you have completed your 1099-MISC form, you can file it with your tax return to report your miscellaneous income to the IRS. Make sure to keep a copy of the form for your records, as well as any documentation of your income, such as invoices or receipts.

Using a printable 1099-MISC form can help simplify the process of reporting your miscellaneous income and ensure that you are in compliance with IRS regulations. Be sure to carefully review the instructions provided with the form to ensure that you are filling it out correctly and reporting all necessary information.

Overall, printable 1099-MISC forms are a convenient and easy way to report your miscellaneous income to the IRS. By accurately reporting your income, you can avoid potential penalties and ensure that you are in good standing with the IRS. So don’t wait until the last minute – download your printable 1099-MISC form today and start reporting your income accurately.