As tax season approaches, it’s important for businesses and individuals to stay organized and ensure they have all the necessary forms to report their income accurately. One such form is the 1096 Form, which is used to report miscellaneous income to the IRS. Having a printable version of the 1096 Form for the year 2018 can make the process easier and more convenient.

Printable forms are convenient because they allow you to fill out the necessary information by hand or electronically before submitting them to the IRS. This can help prevent errors and ensure that all information is accurate and complete. The 1096 Form is typically used to summarize and transmit information from various 1099 forms, such as those used for independent contractors, rental income, royalties, and other types of miscellaneous income.

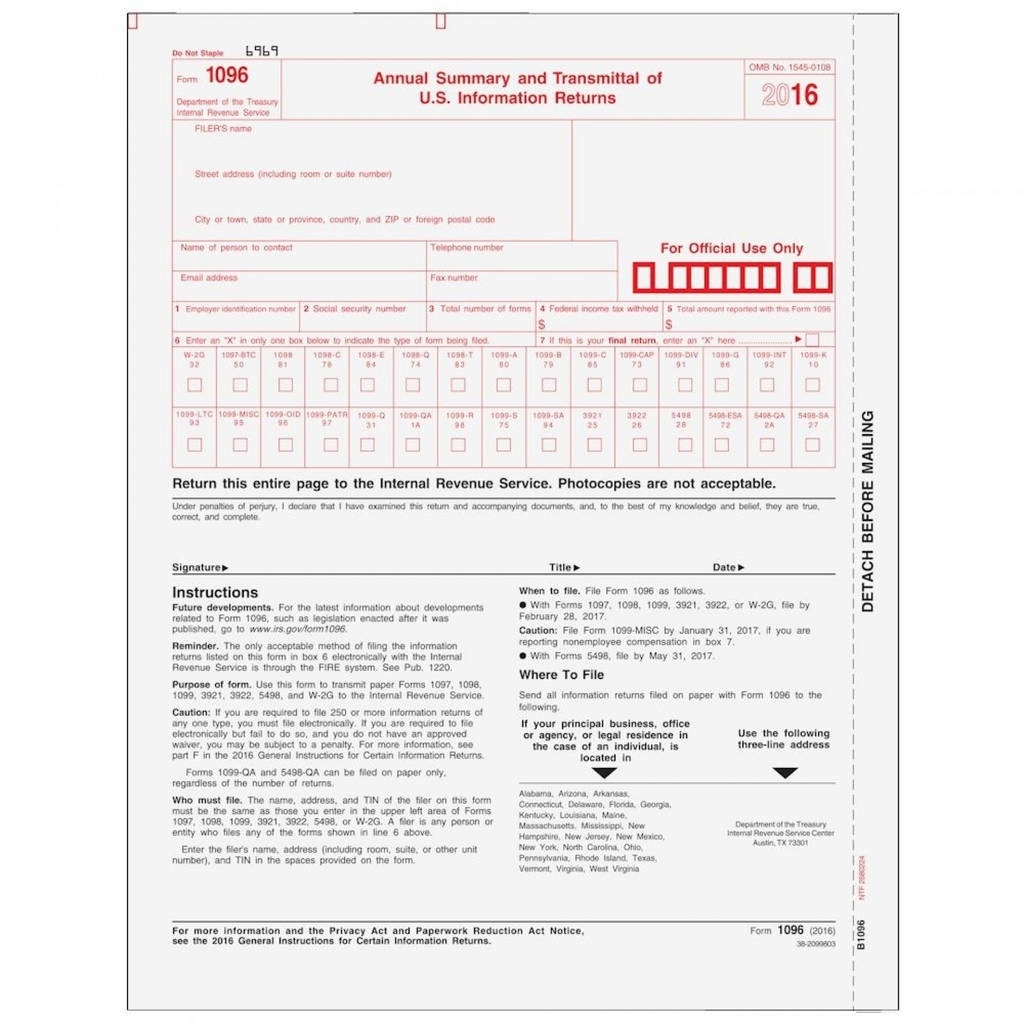

Printable 1096 Form 2018 Miscellaneous Income

Printable 1096 Form 2018 Miscellaneous Income

When using a printable 1096 Form for 2018, it’s important to double-check that you are using the correct version for that specific tax year. The IRS updates forms and requirements regularly, so using outdated forms can lead to penalties or delays in processing. By ensuring you have the most up-to-date form, you can avoid potential issues and make the filing process smoother.

It’s also important to accurately report all miscellaneous income on the 1096 Form to avoid any discrepancies or audits from the IRS. Make sure to gather all necessary documentation, such as 1099 forms from payers, before filling out the 1096 Form. This will help you provide accurate information and avoid any potential issues with your tax return.

Overall, having a printable 1096 Form for 2018 can simplify the process of reporting miscellaneous income to the IRS. By using the correct form and providing accurate information, you can ensure that your taxes are filed correctly and avoid any penalties or delays. Be sure to consult with a tax professional if you have any questions or concerns about filling out the form.

Get your Printable 1096 Form 2018 Miscellaneous Income here.