When entering into a personal loan agreement, it is important to have a written document that outlines the terms and conditions of the loan. This not only protects both parties involved, but also helps to prevent any misunderstandings or disputes in the future. One way to ensure that the agreement is legally binding and clear is to use a printable loan agreement template.

By using a printable loan agreement template, both the lender and borrower can easily fill in the necessary information and sign the document. This makes it a convenient and efficient way to formalize the loan agreement without the need for lengthy negotiations or legal consultations. Additionally, having a written agreement helps to establish the terms of the loan, such as the amount borrowed, interest rate, repayment schedule, and any other relevant details.

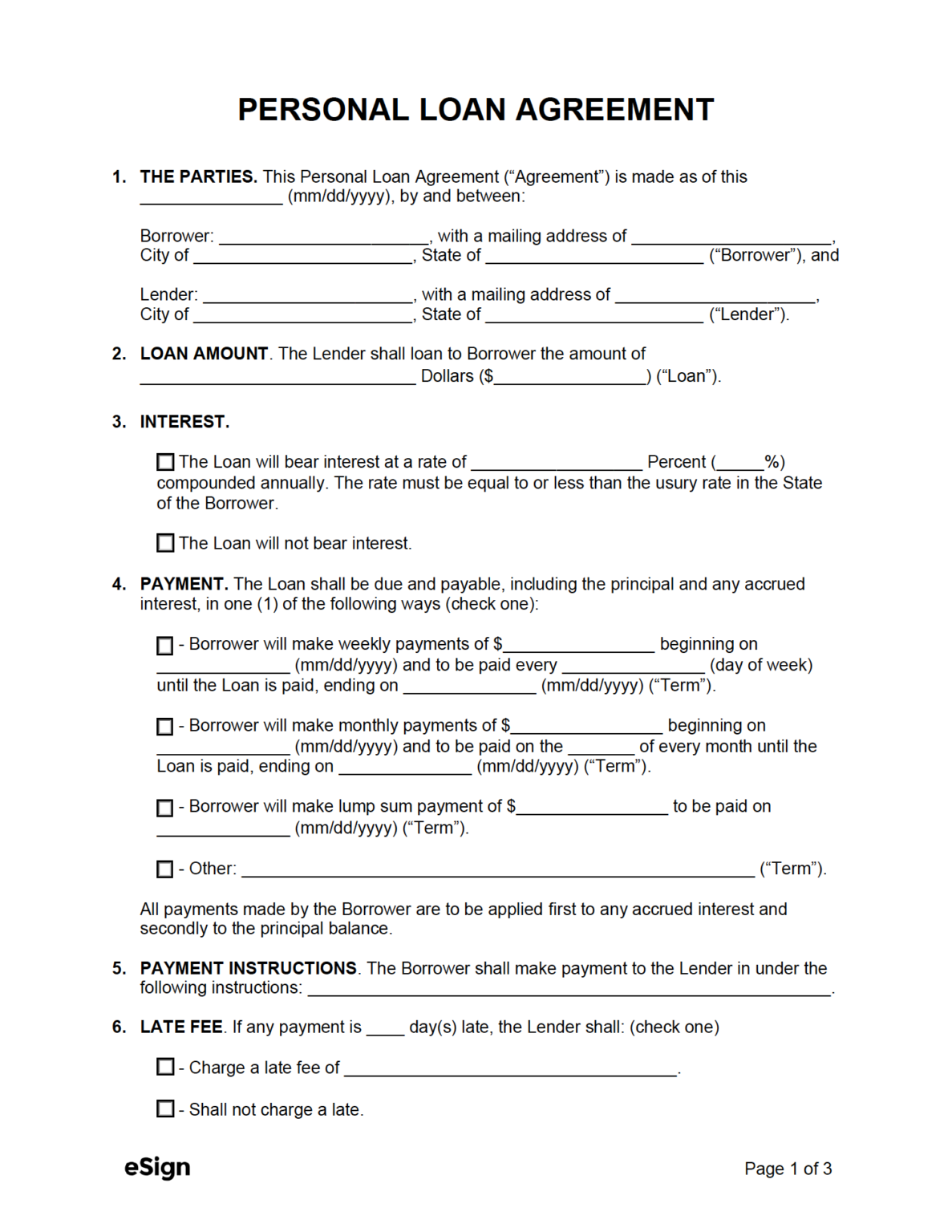

Personal Loan Agreement Printable

Personal Loan Agreement Printable

One of the key advantages of using a printable loan agreement template is that it provides a clear record of the loan transaction. In the event of any disputes or disagreements, both parties can refer back to the agreement to clarify the terms that were agreed upon. This can help to protect the interests of both the lender and borrower and ensure that the loan is repaid in a timely manner.

Furthermore, having a written loan agreement can also help to establish trust and transparency between the parties involved. By clearly outlining the terms of the loan in a formal document, both the lender and borrower can feel confident that they are entering into a fair and mutually beneficial agreement. This can help to build a positive relationship between the parties and prevent any potential conflicts or misunderstandings.

In conclusion, using a printable loan agreement template is a simple yet effective way to formalize a personal loan agreement. By clearly outlining the terms and conditions of the loan in a written document, both parties can protect their interests and ensure that the loan is repaid as agreed. Whether you are lending money to a friend or family member, or borrowing funds for a personal expense, having a written agreement can provide peace of mind and clarity for all parties involved.