Filing your taxes can be a daunting task, but with the right resources, it can be made much easier. In Pennsylvania, residents are required to file their personal income taxes annually. To help streamline this process, the state provides printable tax forms that can be easily accessed and filled out.

PA personal income tax forms are available for download on the Pennsylvania Department of Revenue website. These forms include the PA-40, which is the standard income tax return form for residents, as well as various schedules and worksheets that may be needed depending on your individual tax situation.

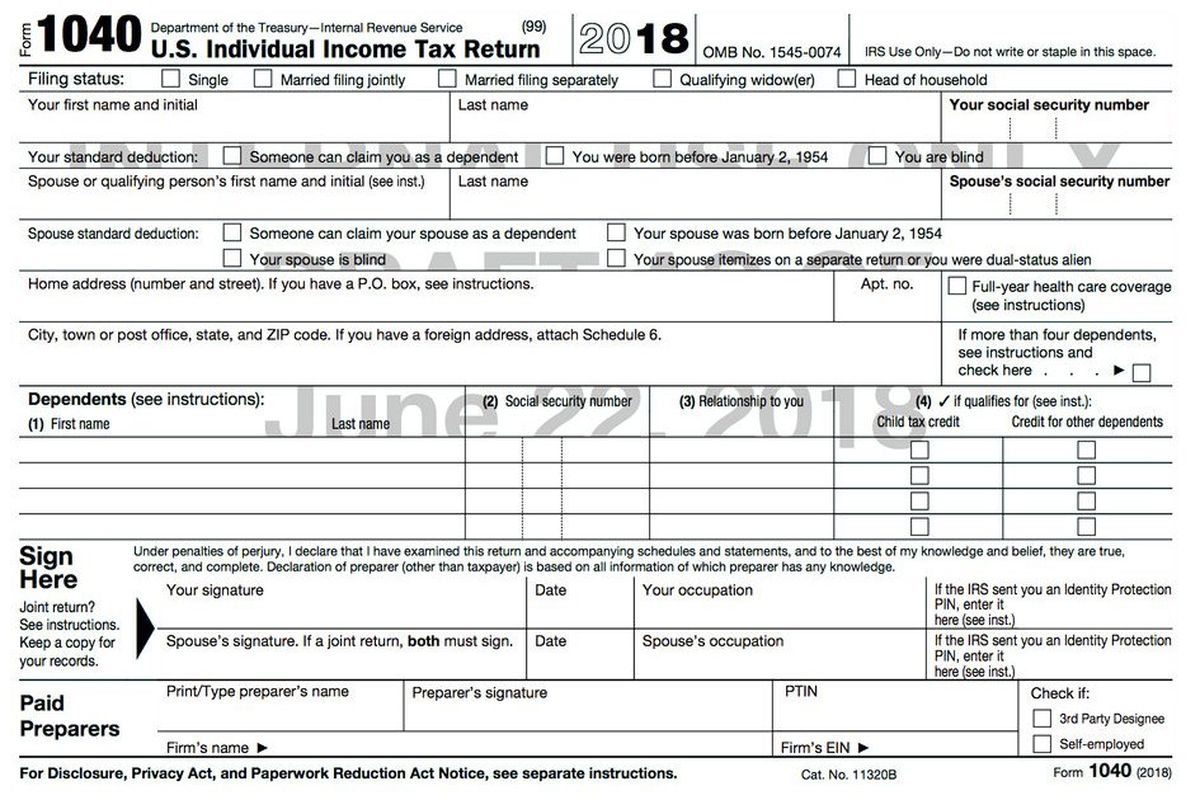

Pa Personal Income Tax Forms Printable

Pa Personal Income Tax Forms Printable

When filling out your PA personal income tax forms, it is important to have all necessary documentation on hand, such as W-2 forms, 1099 forms, and any other relevant financial information. Be sure to double-check your calculations and information before submitting your forms to avoid any errors or delays in processing.

If you prefer to file your taxes online, the Pennsylvania Department of Revenue also offers an e-filing option for personal income taxes. This can be a convenient and secure way to submit your tax return and receive any refunds that may be owed to you.

Keep in mind that the deadline for filing your PA personal income tax return is typically April 15th, unless this date falls on a weekend or holiday. In that case, the deadline is extended to the next business day. Failing to file your taxes on time can result in penalties and interest, so it is important to make sure you meet the deadline.

Overall, utilizing PA personal income tax forms printable can make the process of filing your taxes much simpler and more efficient. By being organized and thorough in your preparation, you can ensure that your tax return is accurate and submitted on time. Remember to consult with a tax professional if you have any questions or concerns about your tax situation.

In conclusion, accessing and using PA personal income tax forms printable is a valuable resource for Pennsylvania residents. By taking advantage of these forms and carefully following the instructions provided, you can successfully navigate the tax filing process and fulfill your obligations as a taxpayer.