Ohio residents who need to file their income taxes can easily access and download printable forms from the Ohio Department of Taxation website. These forms are essential for individuals and businesses to report their income, deductions, and credits accurately to ensure compliance with state tax laws.

Whether you are filing as a single individual, a married couple, or a business entity, having the necessary forms at your fingertips can streamline the tax filing process and help you avoid potential errors or delays in processing your return.

Ohio Printable Income Tax Forms

Ohio Printable Income Tax Forms

Ohio Printable Income Tax Forms

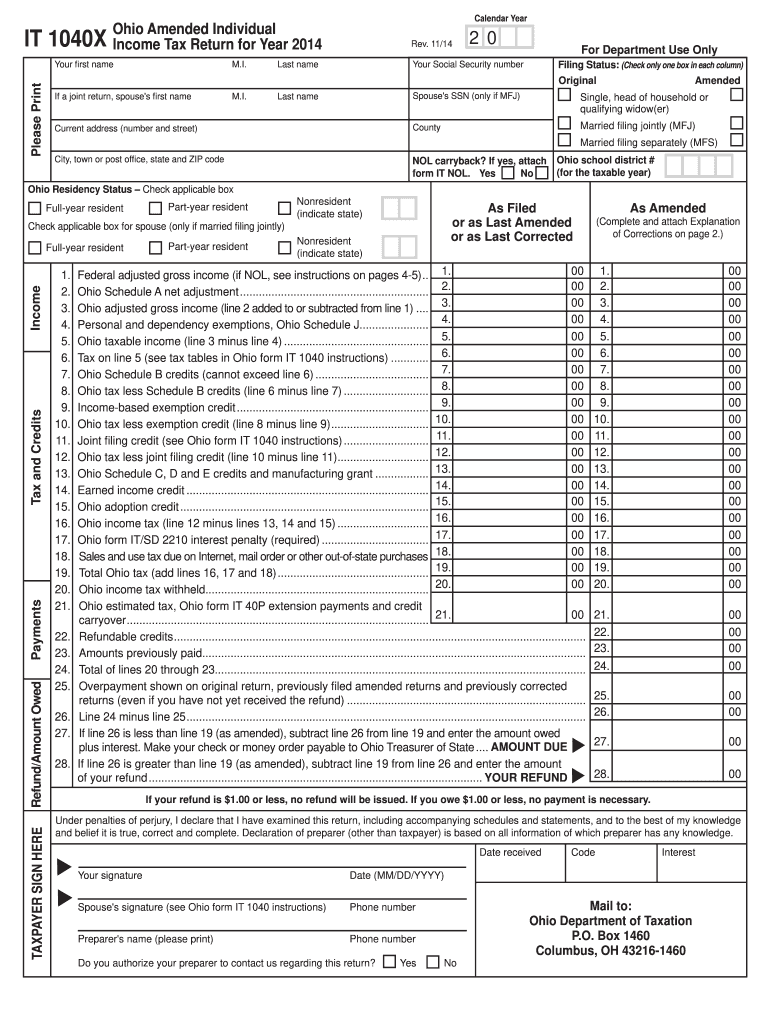

When it comes to filing your Ohio income taxes, there are several printable forms available to meet your specific needs. The most commonly used forms include the Ohio Individual Income Tax Return (IT 1040), which is used by individuals to report their annual income, deductions, and credits.

For businesses, the Ohio Business Income Tax Return (IT 1140) is used to report business income, deductions, and credits for corporations, partnerships, and other types of business entities. Additionally, there are specific forms for reporting rental income, farm income, and other types of income that may be subject to Ohio state taxes.

It is important to carefully review the instructions provided with each form to ensure that you are completing the form correctly and including all necessary documentation to support your income and deductions. Filing your taxes accurately and on time can help you avoid penalties and interest charges that may be imposed for late or incorrect filings.

By utilizing Ohio printable income tax forms, you can simplify the tax filing process and ensure that you are meeting your obligations as a taxpayer in the state of Ohio. Whether you choose to file your taxes online or by mail, having the necessary forms readily available can help you stay organized and on track with your tax preparation.

In conclusion, Ohio printable income tax forms are essential tools for individuals and businesses to report their income, deductions, and credits accurately to the Ohio Department of Taxation. By accessing and downloading these forms from the official website, taxpayers can simplify the tax filing process and ensure compliance with state tax laws.