Managing incoming customer payments is a crucial aspect of running a successful business. It is essential to keep track of all payments received from customers to ensure accurate financial records and to avoid any discrepancies. One way to efficiently manage and document these payments is by using an incoming customer payment log printable.

By utilizing an incoming customer payment log printable, businesses can easily record and track all payments received from customers. This log can help businesses stay organized, monitor payment trends, and identify any outstanding payments that need to be followed up on. Having a documented record of all incoming payments can also be beneficial for tax purposes and financial reporting.

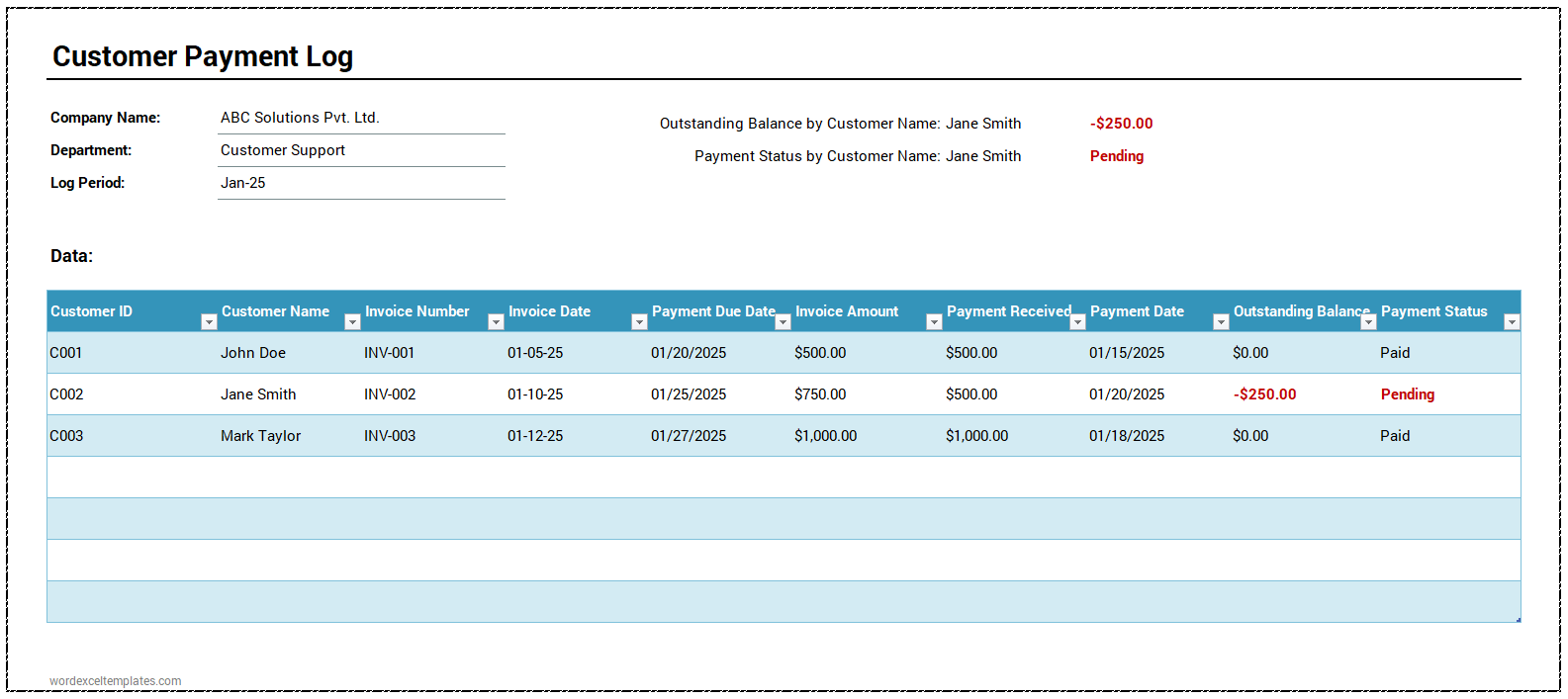

Incoming Customer Payment Log Printable

Incoming Customer Payment Log Printable

Incoming Customer Payment Log Printable

An incoming customer payment log printable typically includes fields for the customer’s name, payment amount, payment date, invoice number, and payment method. This template allows businesses to easily input and track incoming payments in an organized manner. By using a printable log, businesses can save time and effort in manually recording and tracking payments.

Additionally, having a printable log can serve as a backup in case of any discrepancies or disputes with customers regarding payment. Businesses can refer back to the payment log to provide evidence of when and how a payment was received. This can help resolve any payment-related issues efficiently and effectively.

Furthermore, an incoming customer payment log printable can also be customized to fit the specific needs of a business. Businesses can add additional fields or categories to the log to capture more detailed information about incoming payments. This customization can help businesses tailor the log to their unique payment tracking requirements.

In conclusion, keeping an incoming customer payment log printable is essential for businesses to effectively manage and track all payments received from customers. By utilizing a printable log, businesses can maintain accurate financial records, monitor payment trends, and resolve any payment-related disputes efficiently. Overall, having a documented record of incoming payments is crucial for the financial health and success of a business.