Income tax is a mandatory contribution levied by the government on individuals and organizations based on their income. Filing income tax returns is a crucial aspect of financial planning and compliance with tax laws. To simplify the process, the government provides printable forms that taxpayers can fill out and submit.

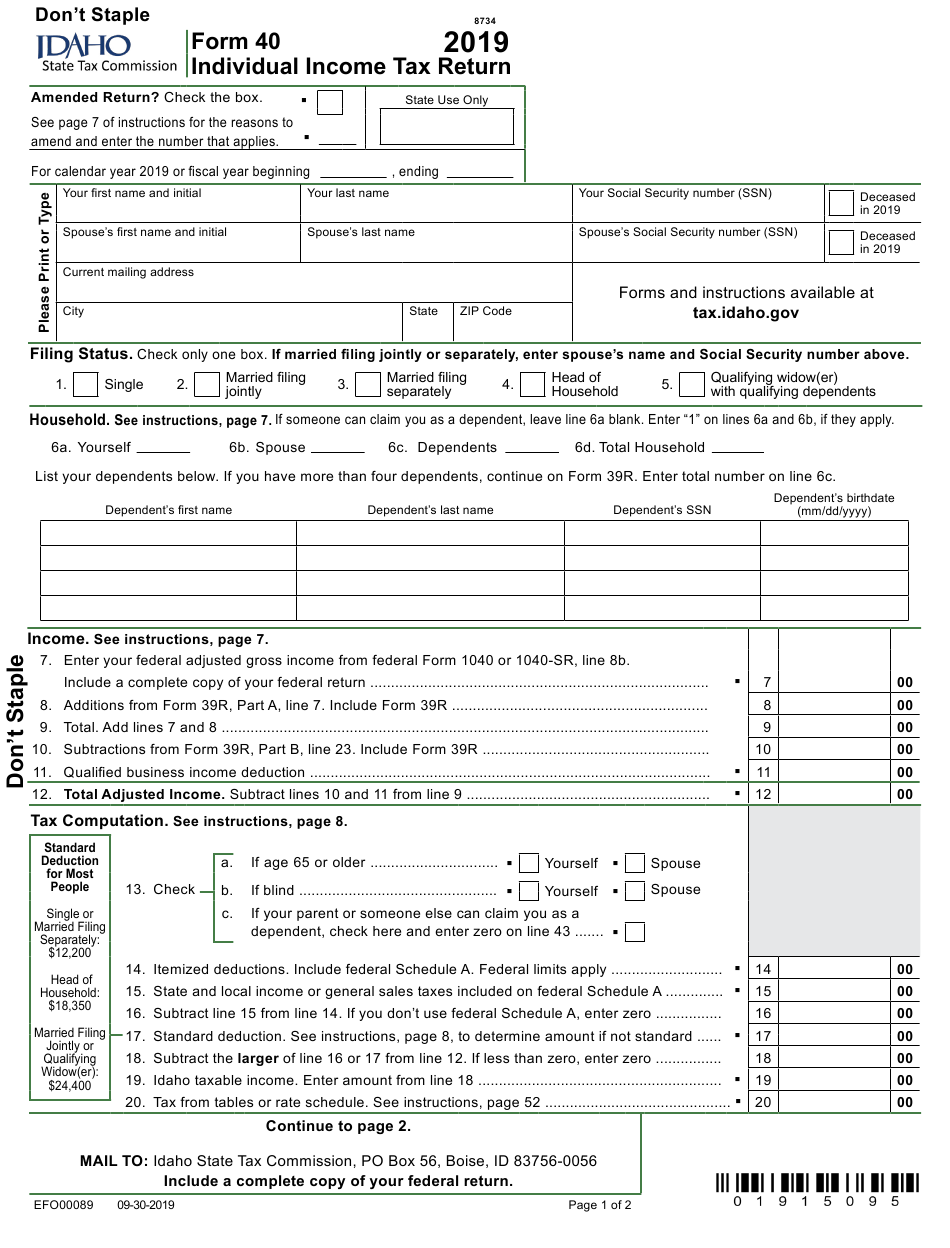

Income tax printable forms are essential documents that help individuals and businesses report their income, deductions, and tax liability to the tax authorities. These forms are available on the official website of the tax department and can be easily downloaded and printed for filing purposes.

There are various types of income tax printable forms, depending on the nature of income and the taxpayer’s status. For individuals, Form 1040 is the most common form used to report income, deductions, and credits. Businesses may need to file Form 1120 or Form 1065, depending on their legal structure.

When filling out income tax printable forms, it is essential to provide accurate and complete information to avoid penalties or audits. Taxpayers should carefully review the instructions provided with the form and seek professional assistance if needed. It is also crucial to keep copies of all documents submitted for future reference.

Once the income tax printable forms are filled out correctly, taxpayers can submit them either electronically or by mail to the tax authorities. Electronic filing is preferred by many as it is faster and more convenient. However, some individuals may still prefer to file a paper return for various reasons.

In conclusion, income tax printable forms are essential tools for taxpayers to report their income and comply with tax laws. By understanding the different types of forms available and following the instructions carefully, individuals and businesses can ensure smooth and accurate filing of their tax returns.