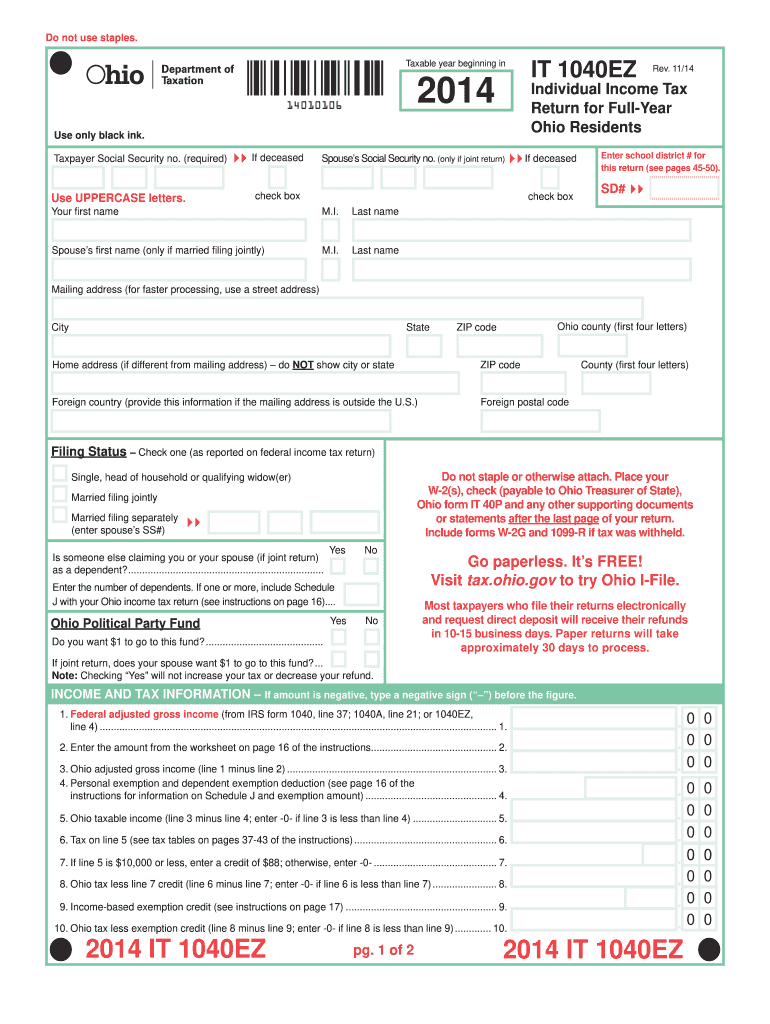

Income tax forms are an essential part of filing taxes each year. For the tax year 2014, it is important to have the correct forms in order to accurately report your income and deductions. Printable forms make the process easier for individuals who prefer to fill out their forms by hand rather than online. These forms provide a clear outline of what information is needed and where to enter it.

When it comes to income tax forms for the year 2014, having the printable versions can make the process of filing taxes much simpler. These forms are easily accessible online and can be printed out for your convenience. Whether you are filing as an individual or a business, having the correct forms is crucial for accurate reporting.

Income Tax Forms 2014 Printable

Income Tax Forms 2014 Printable

Income Tax Forms 2014 Printable

There are several key forms that individuals may need for their 2014 taxes. This includes Form 1040, which is the standard individual income tax return form. Additionally, there are various schedules that may need to be included, such as Schedule A for itemized deductions or Schedule C for self-employment income. Having these forms printed and ready to fill out can help streamline the tax filing process.

For businesses, there are also specific forms that need to be filled out for the 2014 tax year. This may include Form 1120 for corporations or Form 1065 for partnerships. These forms outline the income, deductions, and credits for the business, providing a comprehensive overview of the financial standing for the year.

By utilizing printable income tax forms for the year 2014, individuals and businesses can ensure they are accurately reporting their financial information to the IRS. These forms provide a structured format for reporting income, deductions, and credits, making the tax filing process more organized and efficient.

Overall, having access to printable income tax forms for the year 2014 is essential for anyone looking to file their taxes accurately and on time. By utilizing these forms, individuals and businesses can ensure they are meeting their tax obligations and avoiding any potential penalties for incorrect reporting. Be sure to download the necessary forms and fill them out carefully to ensure a smooth tax filing process.