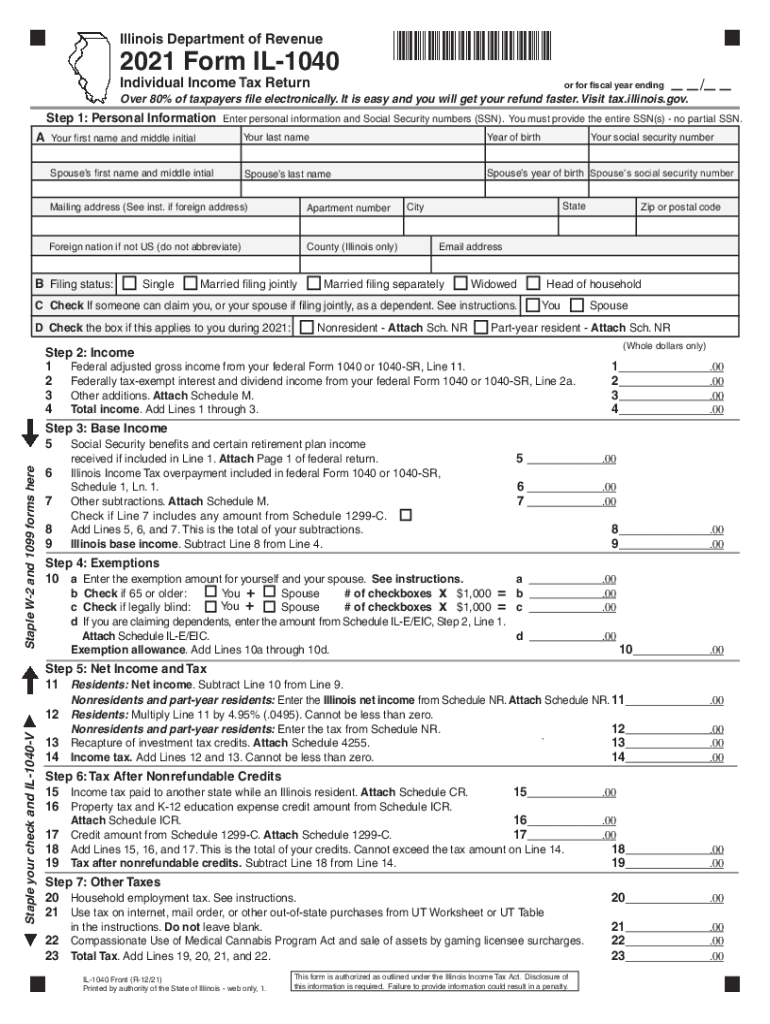

Illinois residents are required to file state income taxes each year. This process can be made easier by utilizing the Illinois State Income Tax Form Printable. By downloading and filling out this form, taxpayers can ensure that they are accurately reporting their income and deductions to the state government.

Completing the Illinois State Income Tax Form Printable allows individuals to calculate how much they owe in state income taxes or if they are eligible for a refund. It is important to fill out this form correctly and thoroughly to avoid any potential penalties or audits from the Illinois Department of Revenue.

Illinois State Income Tax Form Printable

Illinois State Income Tax Form Printable

When filling out the Illinois State Income Tax Form Printable, taxpayers will need to provide information such as their income, deductions, and credits. This form is designed to help individuals report their earnings from various sources, including wages, investments, and self-employment.

Additionally, the Illinois State Income Tax Form Printable includes sections for taxpayers to claim deductions for expenses such as mortgage interest, medical expenses, and charitable contributions. By taking advantage of these deductions, individuals can reduce their taxable income and potentially lower their state income tax liability.

Once the Illinois State Income Tax Form Printable is completed, taxpayers can either file their taxes electronically or mail the form to the Illinois Department of Revenue. It is important to submit the form by the state’s tax deadline to avoid late fees or penalties.

In conclusion, the Illinois State Income Tax Form Printable is a valuable tool for residents to accurately report their income and deductions to the state government. By utilizing this form, individuals can ensure that they are in compliance with Illinois tax laws and potentially reduce their state income tax liability. Download the form today to start preparing for tax season!