When it comes to filing taxes for trusts in Illinois, it’s important to have the necessary forms on hand to ensure compliance with state regulations. The Illinois State Income Tax Form for Trusts Printable 2016 is a key document that trustees will need to fill out accurately to report trust income and calculate taxes owed.

Trusts are legal entities that can hold assets on behalf of beneficiaries. If a trust generates income, it must file a tax return and pay taxes on that income. The Illinois State Income Tax Form for Trusts Printable 2016 provides a structured format for trustees to report income, deductions, and credits for the tax year.

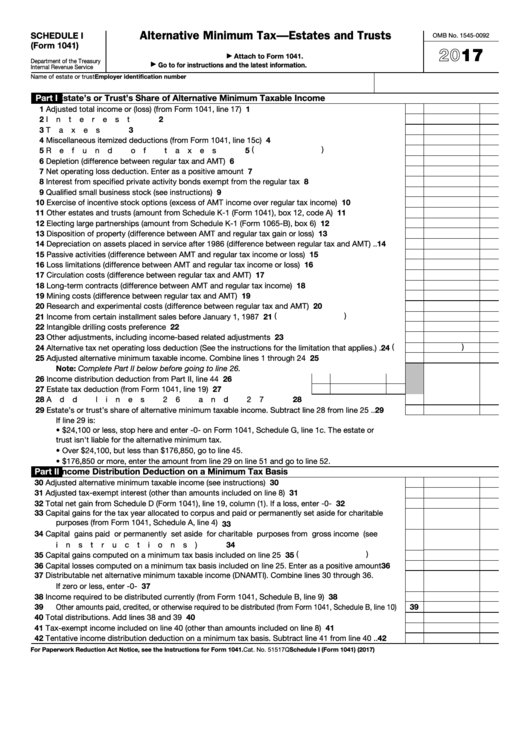

Illinois State Income Tax Form For Trusts Printable 2016

Illinois State Income Tax Form For Trusts Printable 2016

When filling out the form, trustees will need to provide information such as the trust’s name, address, and federal identification number. They will also need to detail the sources of income for the trust, including interest, dividends, and capital gains. Deductions such as expenses related to managing the trust can also be included on the form.

One important aspect of the Illinois State Income Tax Form for Trusts Printable 2016 is the calculation of taxes owed. Trustees will need to determine the trust’s taxable income and apply the appropriate tax rates to calculate the final tax liability. Any credits or payments already made should also be noted on the form.

Once the form is completed, trustees can submit it to the Illinois Department of Revenue along with any required documentation. It’s important to file the form accurately and on time to avoid penalties or interest charges. By using the Illinois State Income Tax Form for Trusts Printable 2016, trustees can simplify the tax filing process and ensure compliance with state regulations.

In conclusion, the Illinois State Income Tax Form for Trusts Printable 2016 is a critical document for trustees to accurately report trust income and calculate taxes owed. By providing a structured format for reporting income, deductions, and credits, the form helps trustees fulfill their tax obligations and avoid potential penalties. Trusts in Illinois should make sure to use the printable form when filing their taxes to ensure compliance with state regulations.