Illinois state income tax forms for trusts are an essential part of fulfilling tax obligations for any trust established in the state. These forms help trustees accurately report income, deductions, and credits to ensure compliance with state tax laws. To make the process easier, Illinois provides printable forms that trustees can fill out and submit to the Department of Revenue.

Trusts in Illinois are subject to state income tax if they have income derived from sources within the state. This includes rental income, interest, dividends, and capital gains. Trustees must report this income on the appropriate tax forms and pay any taxes owed to the state.

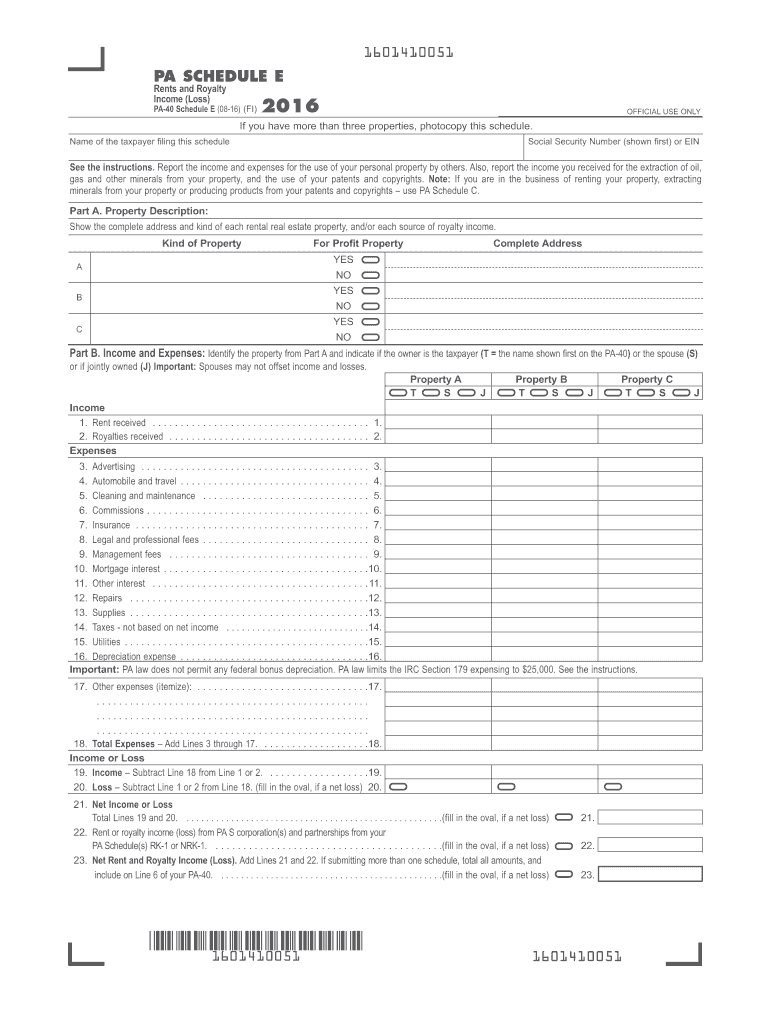

Illinois State Income Tax Form For Trusts Printable

Illinois State Income Tax Form For Trusts Printable

When it comes to filling out the Illinois state income tax form for trusts, trustees will need to provide detailed information about the trust, including its name, address, and federal tax identification number. They will also need to report all sources of income, deductions, and credits to calculate the final tax liability.

Trustees can find printable versions of the Illinois state income tax form for trusts on the Department of Revenue’s website. These forms can be downloaded, printed, and filled out manually or electronically, depending on the trustee’s preference. Once completed, the forms can be submitted by mail or electronically, along with any required documentation and payment.

It is important for trustees to carefully review the instructions provided with the Illinois state income tax form for trusts to ensure accurate reporting. Failure to report income or deductions correctly can result in penalties and interest charges. By using the printable forms and following the guidelines, trustees can effectively meet their tax obligations and avoid any potential issues with the state.

In conclusion, the Illinois state income tax form for trusts is a crucial document that trustees must fill out to comply with state tax laws. By using the printable forms provided by the Department of Revenue, trustees can accurately report income, deductions, and credits to ensure proper tax compliance. Trusts should take the time to review the instructions and fill out the forms carefully to avoid any penalties or interest charges.