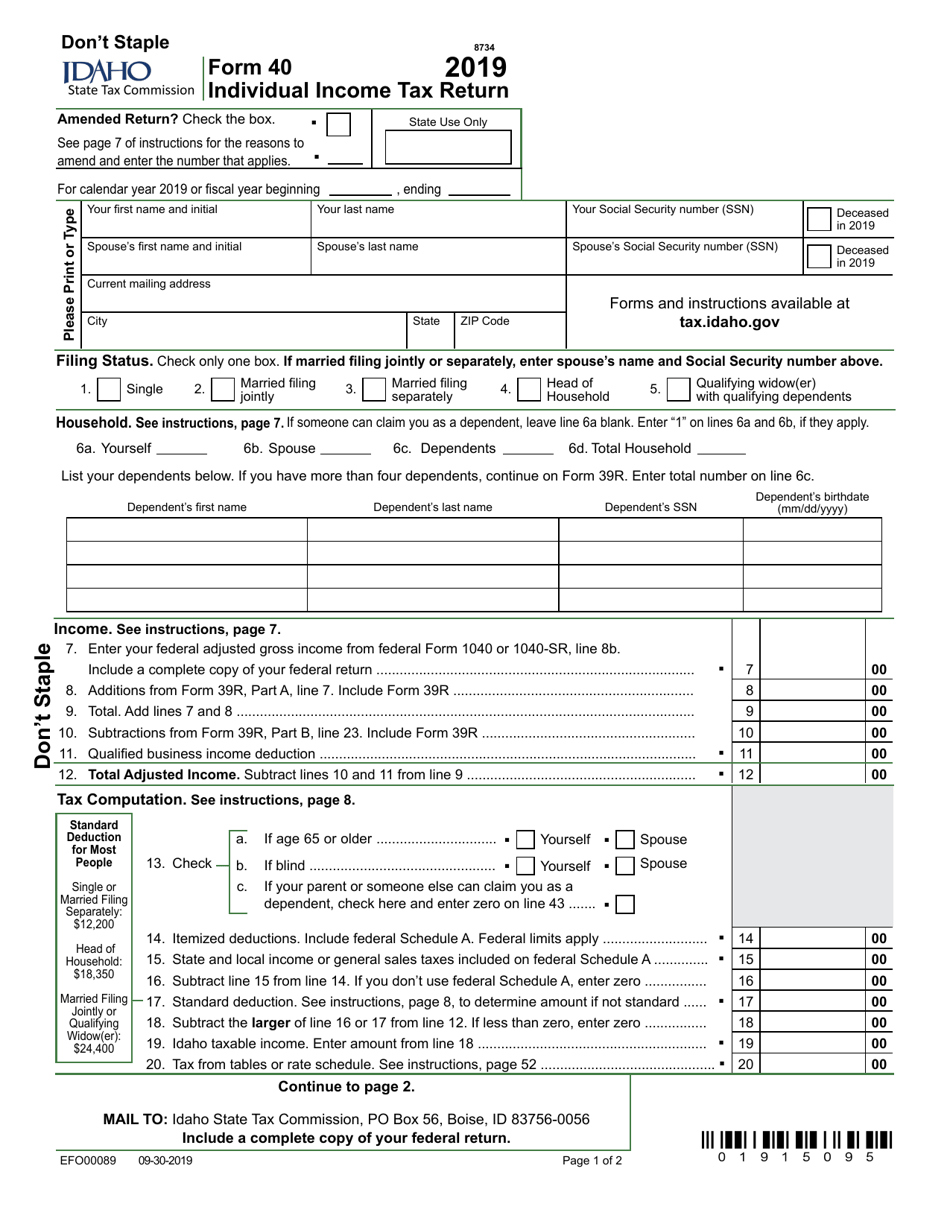

Filing your taxes can be a stressful time of year, but having the right forms and resources can make the process much smoother. For residents of Idaho, the Idaho Individual Income Tax Form 2019 is an essential document for reporting your annual income and calculating any taxes owed to the state.

Whether you are a full-time resident, part-time resident, or nonresident of Idaho, you may be required to file a state income tax return if you earned income in the state during the tax year. The Idaho Individual Income Tax Form 2019 provides a straightforward way to report your income, deductions, and credits to ensure compliance with state tax laws.

Idaho Individual Income Tax Form 2019/Printable

Idaho Individual Income Tax Form 2019/Printable

Form Details

The Idaho Individual Income Tax Form 2019 is available for download on the Idaho State Tax Commission website. This printable form includes sections for personal information, income details, deductions, credits, and tax calculations. It is important to carefully review the instructions provided with the form to accurately complete each section and avoid any errors that could delay processing.

When filling out the Idaho Individual Income Tax Form 2019, be sure to gather all necessary documents, such as W-2s, 1099s, and receipts for deductions. Double-check your calculations and review your entries for accuracy before submitting the form to the Idaho State Tax Commission. Keep a copy of your completed form for your records.

If you have any questions or need assistance with completing the Idaho Individual Income Tax Form 2019, you can contact the Idaho State Tax Commission or consult with a tax professional. It is important to file your state tax return by the deadline to avoid penalties and interest on any unpaid taxes.

Overall, the Idaho Individual Income Tax Form 2019 is a valuable tool for Idaho residents to fulfill their tax obligations and ensure compliance with state tax laws. By taking the time to accurately complete this form and submit it on time, you can avoid unnecessary stress and potential consequences for non-compliance.

Stay informed about any updates or changes to Idaho tax laws and forms to stay current with your tax responsibilities. Remember to keep copies of all tax-related documents for your records and consult with a professional if you have any questions or concerns about your state income tax return.