When it comes to filing your taxes, it’s important to have all the necessary forms and documents ready. In Georgia, residents are required to file a state income tax return each year. For the year 2016, taxpayers will need to use the appropriate forms to report their income, deductions, and credits.

Georgia State Income Tax Forms for 2016 are available for download and printing online. These forms are essential for individuals and businesses to accurately report their income and claim any applicable deductions or credits. By having these forms ready, taxpayers can ensure a smooth and efficient filing process.

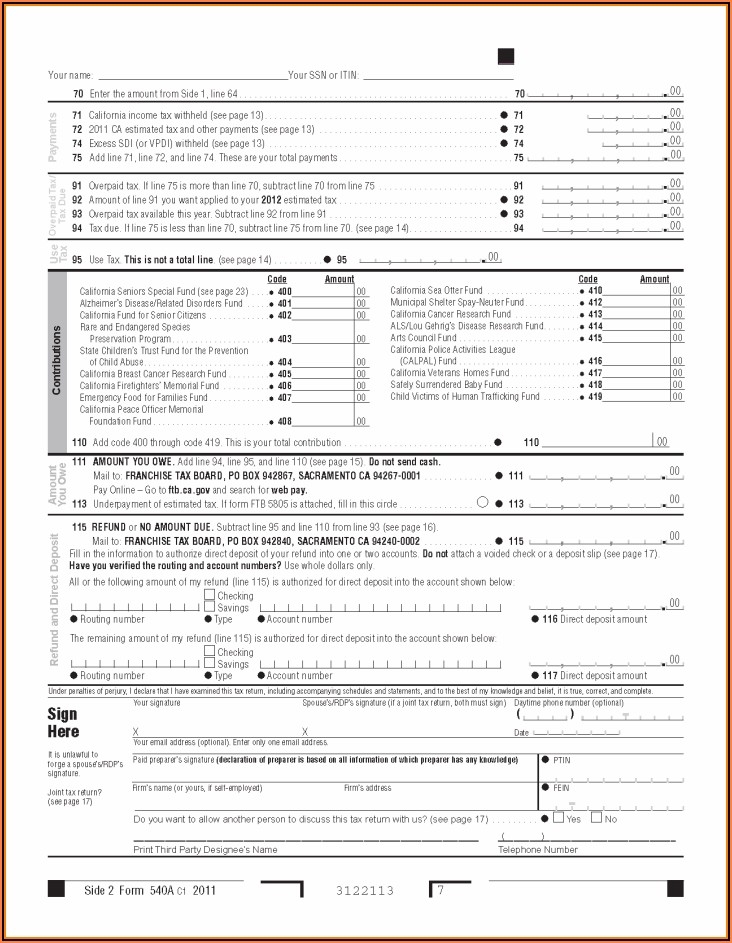

Georgia State Income Tax Forms 2016 Printable

Georgia State Income Tax Forms 2016 Printable

One of the key forms that taxpayers in Georgia will need for the 2016 tax year is the Form 500 Individual Income Tax Return. This form is used by residents to report their income, deductions, and credits for the year. Additionally, there are other forms such as Schedule 1, Schedule 2, and Schedule 3 that may be required depending on the taxpayer’s specific situation.

It’s important for taxpayers to carefully review the instructions provided with each form to ensure that they are filling out the information correctly. Any errors or omissions could result in delays in processing the return or even potential penalties. By using the Georgia State Income Tax Forms 2016 Printable, taxpayers can easily follow along and accurately complete their tax return.

In addition to the printable forms, taxpayers can also file their state income tax return electronically through the Georgia Department of Revenue’s website. This online filing option is convenient and secure, allowing taxpayers to submit their return quickly and receive any refunds faster. However, for those who prefer to file by mail, the printable forms are a great resource to have on hand.

Overall, having access to Georgia State Income Tax Forms 2016 Printable is essential for taxpayers to fulfill their filing requirements. By using these forms, individuals and businesses can accurately report their income, claim deductions and credits, and ensure compliance with state tax laws. Whether filing electronically or by mail, having the necessary forms ready will make the tax filing process much smoother.