Managing your finances is an essential part of adulting, and one of the best ways to do that is by keeping track of your monthly income and expenses. By creating a budget and monitoring where your money is going, you can make informed decisions about your spending and saving habits.

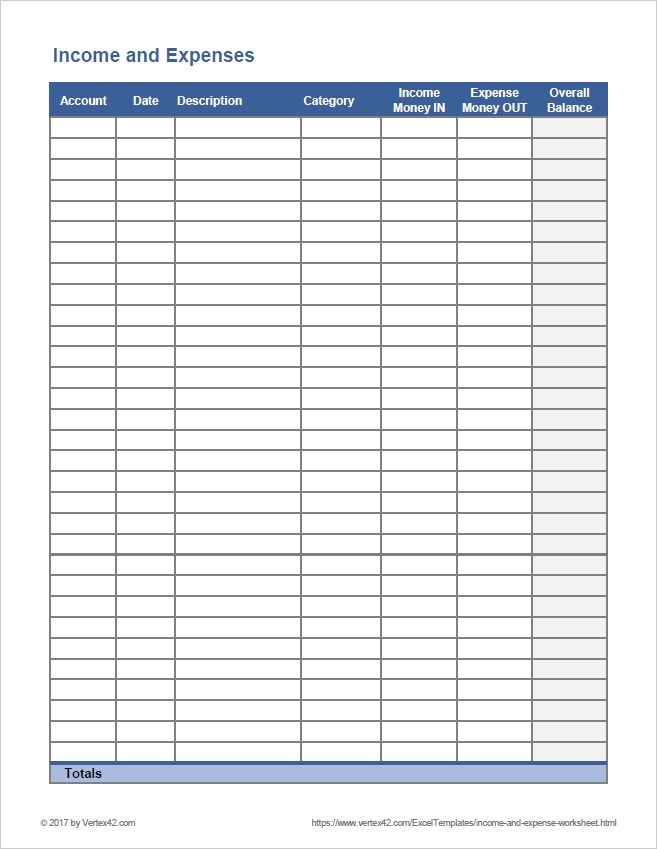

One tool that can help you with this is a free printable monthly income expense sheet. This simple document allows you to list out all your sources of income and expenses for the month, giving you a clear picture of your financial situation.

Free Printable Monthly Income Expense Sheet

Free Printable Monthly Income Expense Sheet

Benefits of Using a Monthly Income Expense Sheet

One of the main benefits of using a monthly income expense sheet is that it helps you see where your money is going. By categorizing your expenses, you can identify areas where you may be overspending and make adjustments accordingly.

Additionally, by tracking your income and expenses each month, you can start to see patterns and trends in your spending habits. This can help you set realistic financial goals and make more informed decisions about your money.

Another benefit of using a monthly income expense sheet is that it can help you plan for the future. By seeing how much money you have coming in and going out each month, you can better prepare for unexpected expenses and save for long-term goals.

How to Use a Monthly Income Expense Sheet

Using a monthly income expense sheet is simple. Start by listing out all your sources of income, such as your salary, side hustle earnings, and any other money you receive each month. Then, list out all your expenses, including bills, groceries, entertainment, and any other spending.

Once you have all your income and expenses listed, subtract your total expenses from your total income to see if you have a surplus or deficit. If you have a surplus, consider putting that extra money towards savings or paying off debt. If you have a deficit, look for areas where you can cut back on spending.

By using a monthly income expense sheet, you can take control of your finances and make smarter decisions about your money. So why not give it a try and see how it can help you reach your financial goals?