As tax season approaches, many individuals and businesses are gearing up to file their income tax returns for the year 2016. One of the key components of this process is having the necessary forms to accurately report your income, deductions, and credits. Fortunately, there are a plethora of free printable forms available online that can help simplify the tax filing process.

Whether you are a salaried employee, self-employed individual, or small business owner, having the right forms is essential to ensure that you are compliant with the tax laws and regulations. By utilizing free printable forms for 2016 income tax, you can save time and money on preparing your tax returns.

Free Printable Foorms For 2016 Income Tax

Free Printable Foorms For 2016 Income Tax

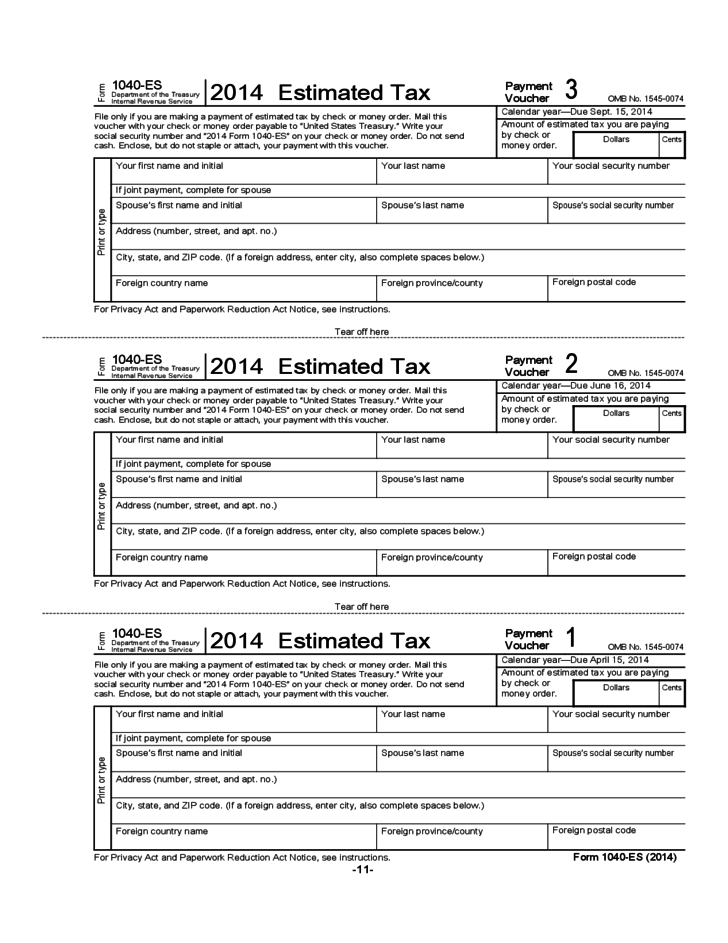

There are several websites that offer a wide range of free printable forms for 2016 income tax, including the IRS website, tax preparation software websites, and other online resources. These forms include the standard Form 1040 for individual tax returns, as well as various schedules and worksheets for reporting specific types of income and deductions.

In addition to federal tax forms, you may also need to file state income tax returns depending on where you live and work. Many state tax agencies also provide free printable forms on their websites, making it easy to file both federal and state tax returns in a timely manner.

Before downloading and using any free printable forms for 2016 income tax, be sure to carefully review the instructions and guidelines provided by the IRS or state tax agency. It is important to accurately report all income, deductions, and credits to avoid any potential penalties or audits.

In conclusion, having access to free printable forms for 2016 income tax can greatly simplify the tax filing process and help ensure that you are in compliance with the law. By utilizing these resources, you can save time and money on preparing your tax returns and focus on other important aspects of your financial planning.