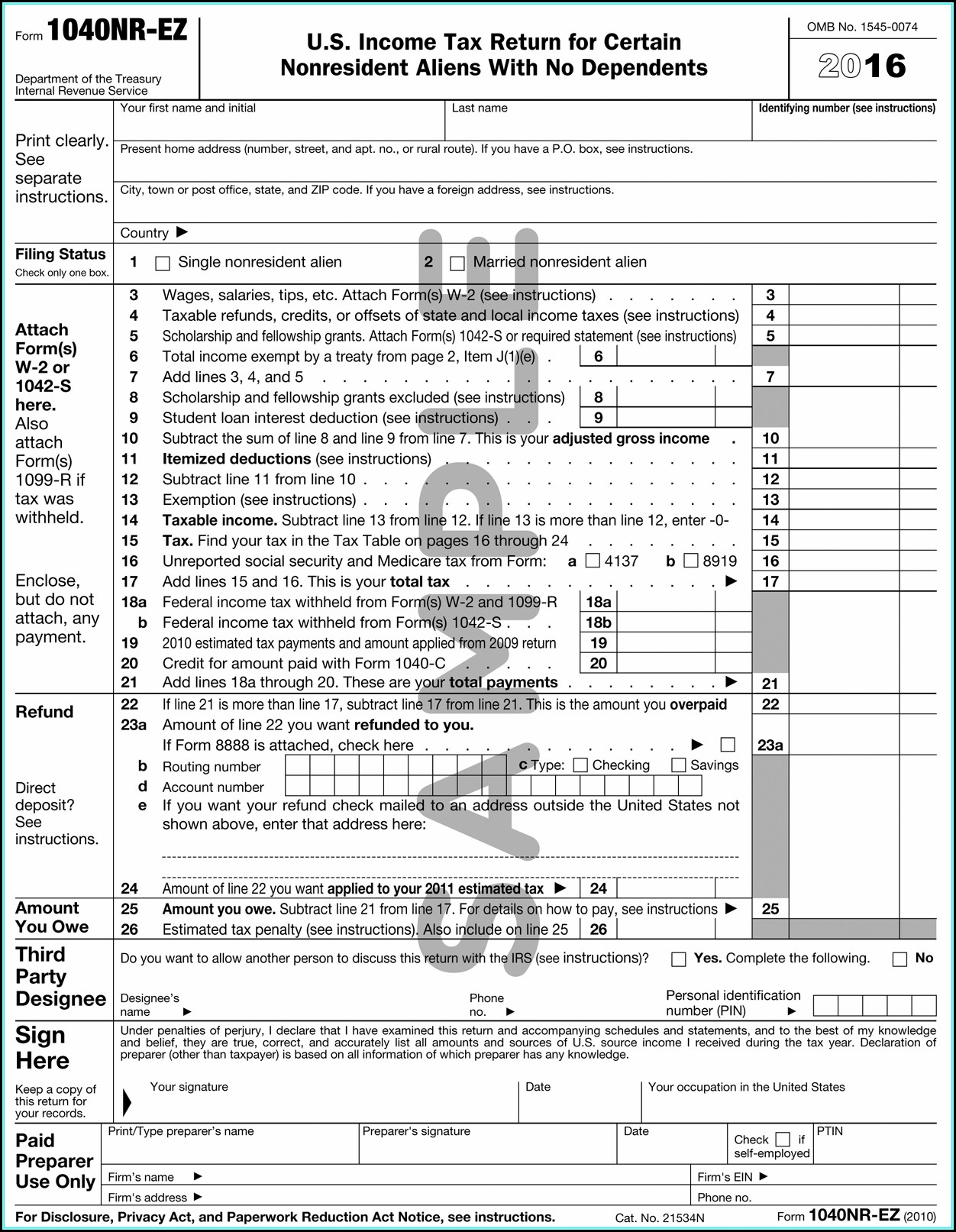

As tax season approaches, it’s important to have all the necessary forms ready to file your taxes. Finding the right forms can sometimes be a hassle, but with free printable options available online, you can easily access and print the forms you need from the comfort of your own home.

When it comes to filing your taxes, having the right forms is crucial. The IRS provides a variety of forms for different types of income, deductions, and credits. By utilizing free printable 2019 income tax forms, you can save time and money by avoiding the need to purchase forms or visit a tax professional.

Free Printable 2019 Income Tax Forms

Free Printable 2019 Income Tax Forms

Whether you are filing as an individual, married couple, or business owner, there are printable forms available for your specific needs. From the standard 1040 form to schedules for itemized deductions, capital gains, and self-employment income, you can easily find and print the forms required to accurately report your income and claim any deductions or credits you qualify for.

By using free printable forms, you also have the convenience of being able to fill them out electronically before printing, making the filing process even easier. Additionally, many online resources provide instructions and guides to help you navigate the forms and ensure you are accurately reporting your income and deductions.

Remember to keep copies of all forms and documentation for your records, and consider utilizing electronic filing options for faster processing and potential refunds. With free printable 2019 income tax forms, you can take control of your tax filing process and ensure you are meeting your obligations as a taxpayer.

Overall, free printable 2019 income tax forms offer a convenient and cost-effective solution for individuals and businesses looking to file their taxes accurately and on time. By accessing these forms online, you can save time and hassle during tax season and ensure that you are meeting all necessary requirements. Take advantage of these resources to simplify your tax filing process and ensure you are maximizing your deductions and credits.