When tax season rolls around, it’s important to have all the necessary forms in order to file your federal income taxes accurately. Fortunately, there are a variety of federal income tax forms that are available for download and printing online. These forms are essential for reporting your income, deductions, and credits to the Internal Revenue Service (IRS).

Whether you are a W-2 employee, self-employed individual, or business owner, there are specific forms that you will need to fill out in order to comply with federal tax laws. By accessing printable federal income tax forms, you can easily navigate through the tax-filing process and ensure that you are submitting the correct information to the IRS.

Federal Income Tax Forms Printable

Federal Income Tax Forms Printable

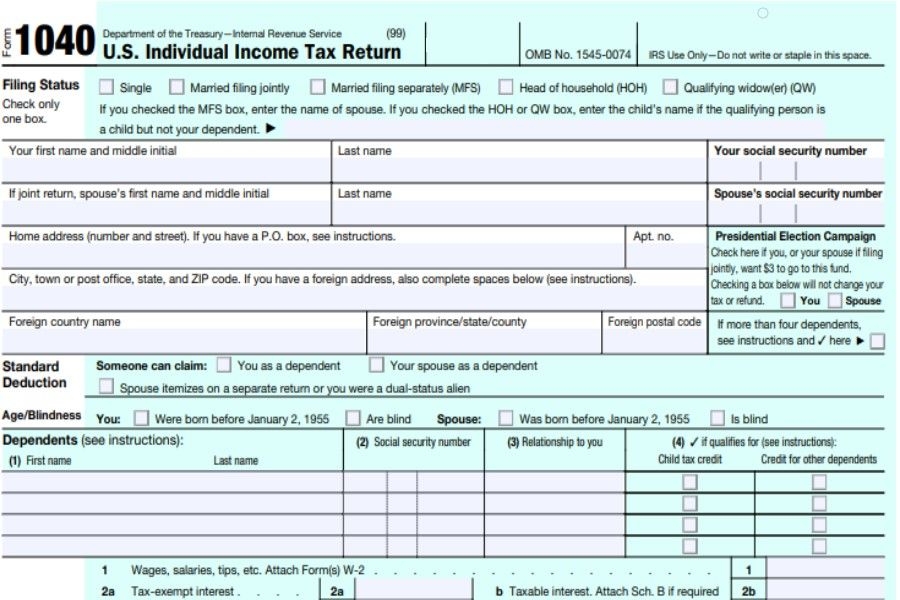

One of the most commonly used federal income tax forms is the 1040 form, which is used by individuals to report their annual income and calculate their tax liability. Additionally, there are various schedules and worksheets that may need to be included with your 1040 form, depending on your specific financial situation.

For self-employed individuals or business owners, there are additional forms such as the Schedule C form for reporting business income and expenses, as well as the 1099-MISC form for reporting income from freelance work or independent contracting. These forms are essential for accurately reporting your income and ensuring that you are in compliance with federal tax laws.

By utilizing printable federal income tax forms, you can take the necessary steps to prepare and file your taxes in a timely manner. Be sure to carefully review each form and its instructions to avoid any errors or omissions that could result in penalties or audits from the IRS. With the right forms and proper documentation, you can successfully navigate the tax-filing process and ensure that you are meeting your obligations as a taxpayer.

Overall, having access to printable federal income tax forms is essential for individuals and businesses alike. By utilizing these forms, you can accurately report your income, deductions, and credits to the IRS and avoid any potential issues during the tax-filing process. Remember to keep copies of all forms and documentation for your records, and consult with a tax professional if you have any questions or concerns about your tax obligations.