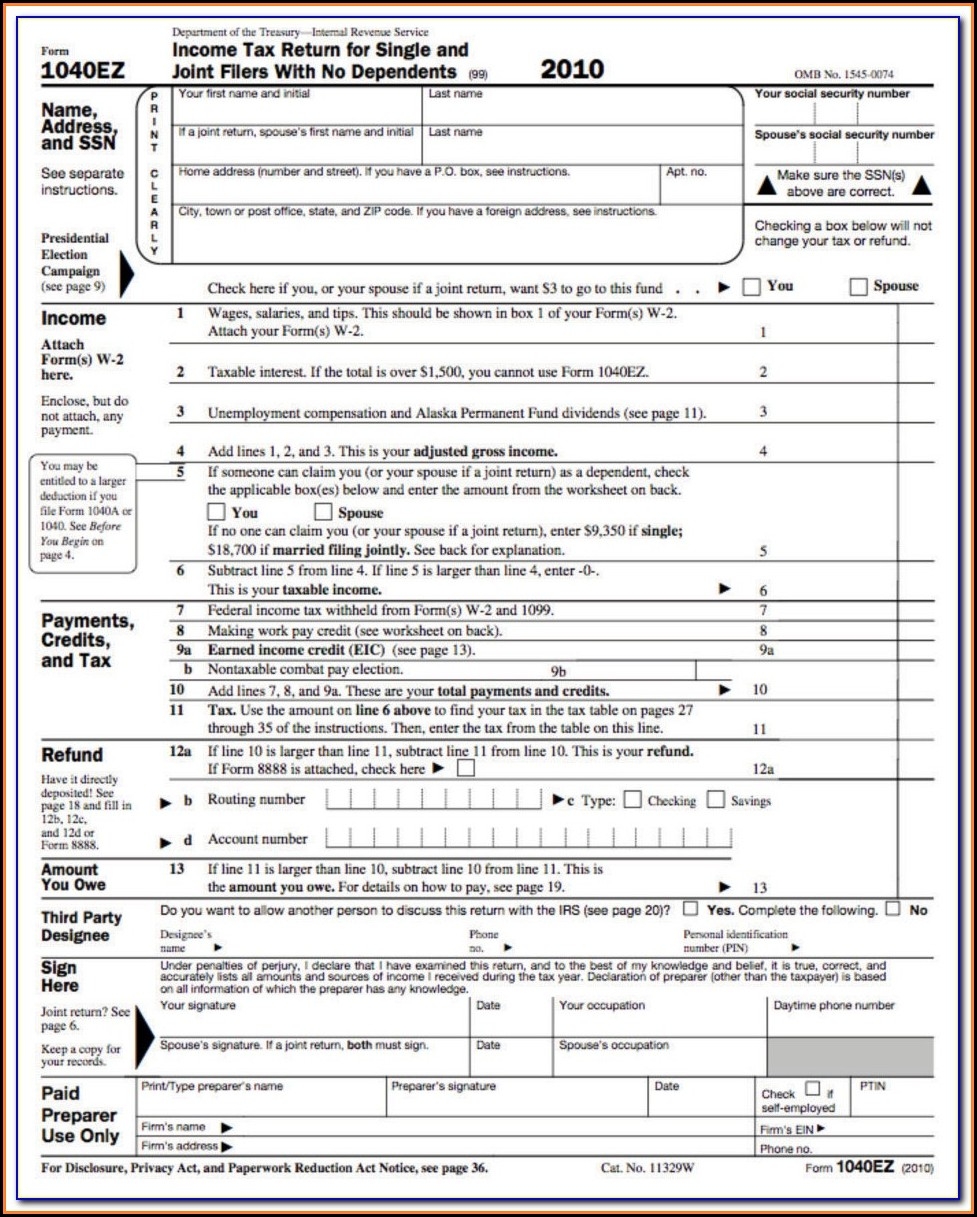

When it comes to filing your federal income taxes, Form 1040a is a popular choice for many taxpayers. This form is shorter and simpler than the regular Form 1040, making it easier to fill out for those who don’t have complex tax situations. It is designed for individuals who have income from wages, salaries, tips, and other sources, but who do not itemize deductions.

Form 1040a is a printable form that can be found on the IRS website or at your local post office. It can be filled out by hand or using tax preparation software. This form is typically used by individuals with total income of less than $100,000, who do not have any dependents, and who do not have any adjustments to income.

Federal Income Tax Form 1040a Printable

Federal Income Tax Form 1040a Printable

When filling out Form 1040a, you will need to provide information about your income, deductions, and credits. You will also need to calculate your tax liability and any refund or amount owed. Once you have completed the form, you can either mail it to the IRS or file electronically.

It is important to note that Form 1040a may not be the best option for everyone. If you have a more complex tax situation, such as owning a business, earning income from investments, or claiming dependents, you may need to file Form 1040 instead. Additionally, if you have more than $100,000 in income, you may not be eligible to use Form 1040a.

Overall, Form 1040a is a convenient and straightforward option for many taxpayers. It allows you to report your income and claim any deductions or credits in a simplified manner. If you are unsure whether Form 1040a is right for you, consider consulting a tax professional for guidance.

In conclusion, Form 1040a is a printable federal income tax form that is ideal for individuals with simple tax situations. It offers a more streamlined approach to reporting income and deductions, making the tax-filing process easier for many taxpayers. Whether you choose to fill out the form by hand or electronically, be sure to review your information carefully before submitting it to the IRS.