When it comes to managing your finances, having a well-organized balance income sheet is essential. This document provides a snapshot of your financial health by detailing your income, expenses, and overall net worth. By keeping track of your financial transactions, you can make informed decisions about budgeting, saving, and investing.

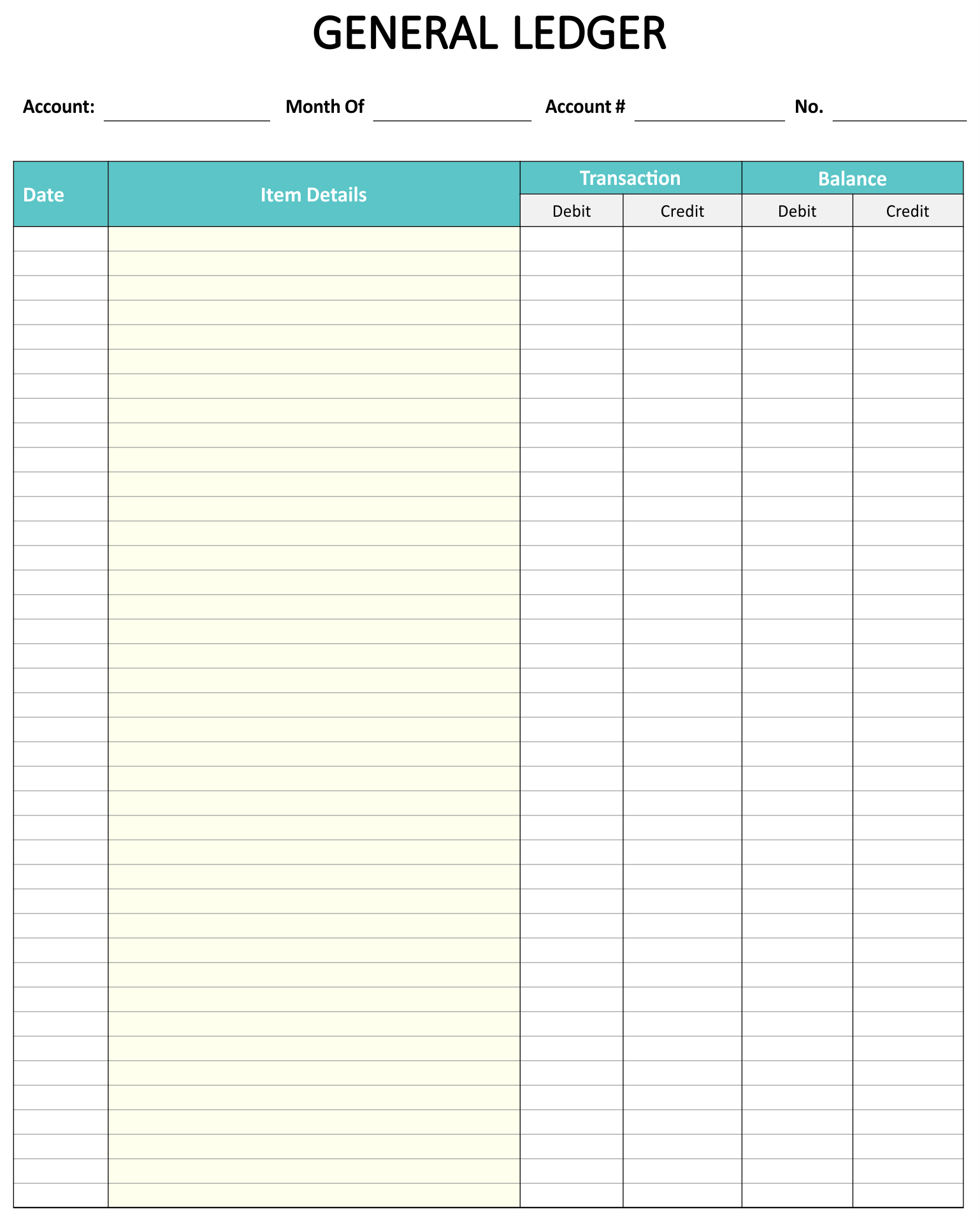

Creating a balance income sheet from scratch can be a daunting task, which is why printable templates are a convenient solution. These templates are pre-formatted with sections for income sources, expenses, assets, and liabilities, making it easy to fill in your financial information and calculate your net worth.

Balance Income Sheets Printable

Balance Income Sheets Printable

Benefits of Using Balance Income Sheets Printable

One of the main benefits of using printable balance income sheets is that they provide a structured format for organizing your financial information. This can help you identify trends in your income and expenses, track your progress towards financial goals, and make adjustments to your budget as needed.

Printable balance income sheets also make it easy to compare your current financial status to previous months or years. By tracking your income and expenses over time, you can see where your money is going and make changes to improve your financial health.

Additionally, using a printable balance income sheet can help you prepare for tax season by organizing your income sources and deductible expenses. This can save you time and stress when it comes time to file your taxes.

Overall, printable balance income sheets are a valuable tool for managing your finances and achieving your financial goals. Whether you’re looking to create a budget, track your spending, or plan for the future, using a printable template can simplify the process and give you a clear picture of your financial health.

In conclusion, balance income sheets printable are a useful resource for anyone looking to take control of their finances. By utilizing these templates, you can track your income, expenses, assets, and liabilities in an organized manner, leading to better financial decision-making and overall financial well-being.